Elliot Bollinger Wave

Description

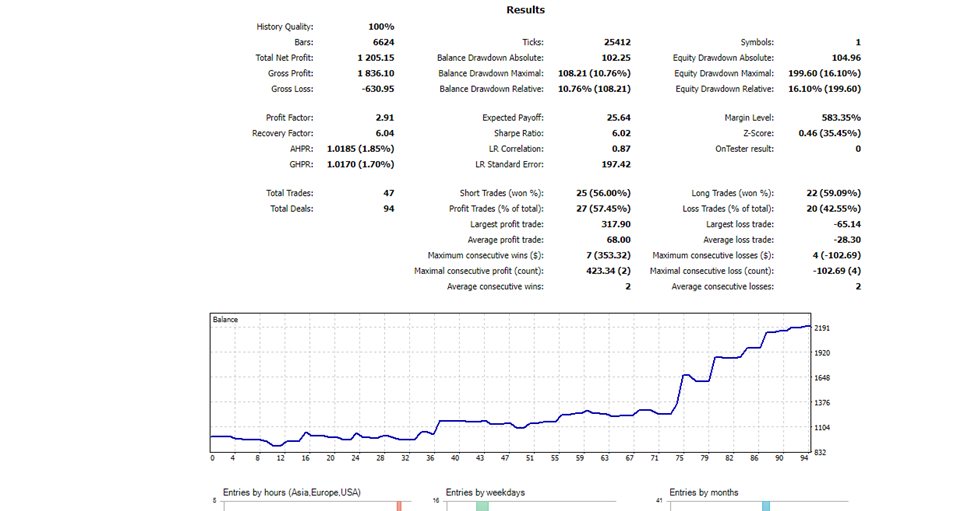

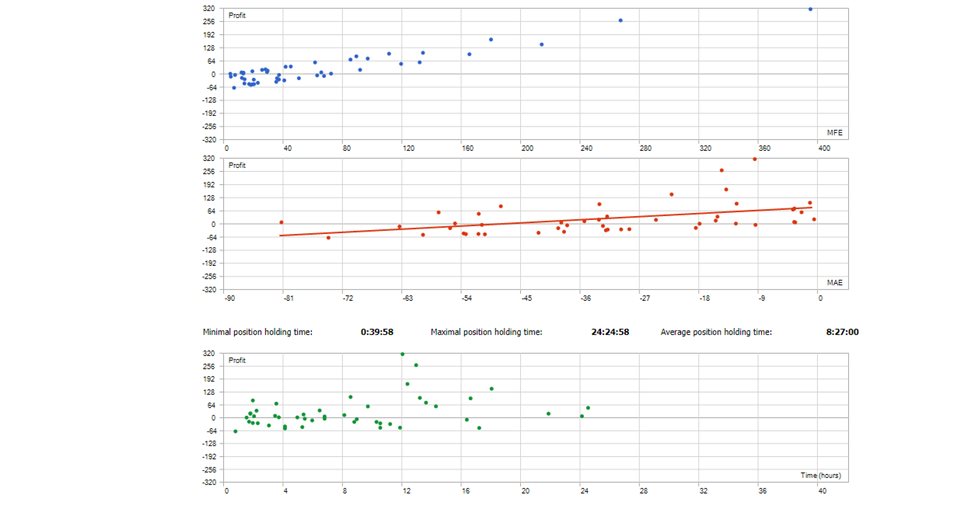

Elliott Wave Bollinger is an Expert Advisor created with the unique strategy that traders don't use so often, enter trades when the 10 moving average moves into the 20 period of the Bollinger Band and Elliott Wave deviates with the Bollinger Bands at the same time between 12-20 deviations and can be traded on fixed lots or martingale.

Strategies

1. The Elliot Wave theory is a technical analysis principle that states that the price of an asset moves in recognizable wave patterns, which can be used to identify the possible direction of price movements in the future.

Corrective waves, which are the usual pullbacks or retracements in a trend, consist of three sub-waves that make net movement in the direction opposite to the trend. As the name implies, it is the price correcting itself after overshooting its mean value.

The corrective wave consists of three sub-waves — wave A (a motive wave in the pullback direction), wave B (a corrective wave in the direction of the main trend), and wave C (another motive wave in the pullback direction). Each of the sub-waves has its own corresponding sub-sub-waves. As with the motive wave, each sub-wave of the pullback never fully retraces the previous sub-wave.

2.Bollinger Bands is a trading tool used to determine entry and exit points for a trade. It is often used to determine overbought and oversold conditions. Using only the bands to trade is a risky strategy as it focuses on price and volatility while ignoring other relevant information. 0 One strategy of using Bollinger Bands is in trend following, which involves buying when other traders are buying and selling when others are selling . 3 Bollinger Bands can add an extra bit of firepower to your analysis by assessing the potential strength of formations. A common Bollinger Band strategy involves a double bottom setup. 1 2 A simple yet effective strategy using Bollinger Bands is playing the Bollinger Bands Squeeze, which is purely a reflection of that volatility. 43.These two strategies work together, and drawdown levels and trade entries are so accurate and deviations together mixed are based on market movements and forecasts for future revenues

Use of EA timeframes and pairs

The right timeframes to use are from 1M up to 4H tested, and the pairs are forex majors, forex minors, commodities, metals, and stocks.

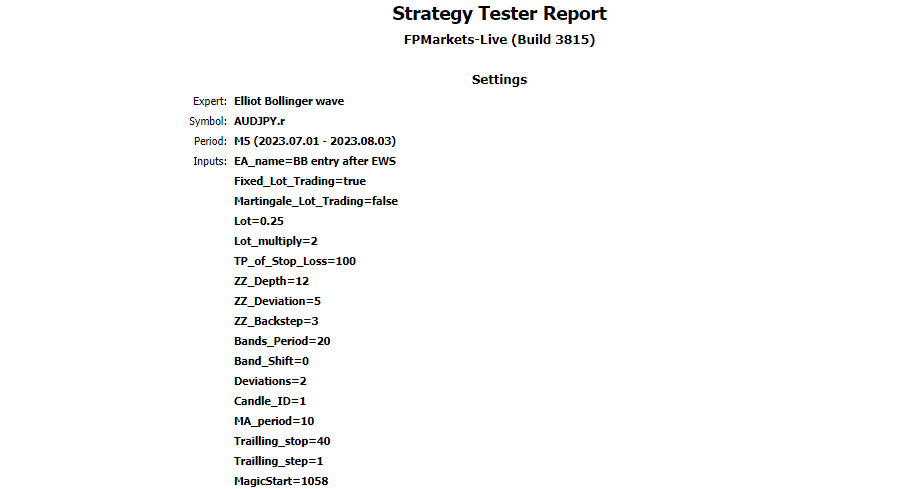

Settings and Warnings

1.The expert advisor contains the option to change from fixed lot to martingale, is really of high importance to switch one lot to another by setting it on true and false.

2.Lots multiply is a option to choose the martingale strategy instead of fixed lot strategy, and it can be modified on a variety of martingale multiplication by numbers 1.0 or 2.0 based on the account size.

3.SL there is no stop loss setting in the EA it is exchanged by the trailing stop and step that can be found inside EA settings and you will see the TP line moving every 10 pips as TP.

4.TP is not standard it is replaced by take profit from the stop loss in amount of 100 which is means(10% from the equity in the account) it always can be changed in lower or higher%

For questions privately