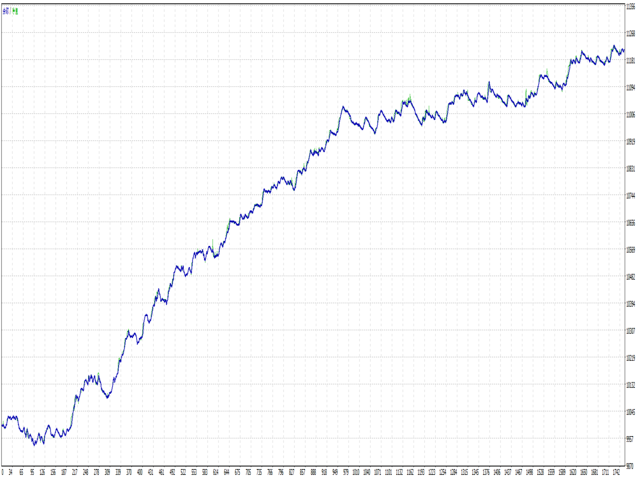

The Kinetic Energy Trend is a very good EA and a momentum strategy.Strategies are all about trends, and today we're going to focus on momentum strategies.Momentum strategy, also known as kinetic energy strategy, also known as inertial strategy and price breakthrough strategy.Is a short - term market volatility, and then we take advantage of the single.Of course, the strategy itself also has many exquisite places, such as how to judge the market volatility, how to set the threshold of volatility, how to get out.

The Kinetic Energy Trend is a very good EA and a momentum strategy.Strategies are all about trends, and today we're going to focus on momentum strategies.Momentum strategy, also known as kinetic energy strategy, also known as inertial strategy and price breakthrough strategy.Is a short - term market volatility, and then we take advantage of the single.Of course, the strategy itself also has many exquisite places, such as how to judge the market volatility, how to set the threshold of volatility, how to get out.

Strategy principle

1. Set two cycles, one for detecting short-term volatility;One is used to detect long-term volatility, which can also be understood as average volatility and conventional volatility.2. Volatility detection: the sum of the entities of the nearest N K lines /N.In other words, the greater the volatility, the larger the k-line entity, and the greater the final volatility.3. Volatility coefficient: short-term volatility/long-term volatility.The greater the coefficient of fluctuation, the greater the kinetic energy.This EA is based on the volatility of open positions.4. That's how it works. If you don't understand, leave a comment.

Directions for use

1. The default parameters of EA published by me apply to EURUSD M5,XAUUSD and M5 cycles.It's not an optimal parameter.2 EA suitable for some of the more volatile varieties, some of the trend of strong varieties we can try, more tuning parameters.3. The optimal period is M5. Try M15, too.4. All trend strategies require patience and are less profitable than Martin's.

parameter setting

Set up a lot

Number of hands per 1,000 dollars

The order comments

The following parameters are used for price breakthrough strategy

Price breakthrough strategy switch

short cycle Short - term volatility to determine how many K lines

long period Long-term volatility is how many K lines to judge

Fluctuation threshold How much volatility to open the position, the greater the value of the more difficult to open the position

Take profit and stop loss calculation cycle The maximum - minimum of the period is the reference point for a stop loss

Stop loss coefficient Stop loss coefficient * The reference points above are the stop loss points

Take profit coefficient The number of points referenced above is the number of points stopped

Breakthrough strategy magic code