What is AlgoMap?

AlgoMap is a cutting-edge trading tool designed to help traders identify and execute two distinct types of trading strategies: trend trades and reversal trades.For trend trades, AlgoMap provides a meticulously crafted map of the market, showing precise entry points, exit points, and trend direction. This invaluable information is essential for traders looking to ride the waves of price movements with confidence. Whether you're a day trader or a long-term investor, AlgoMap's trend trade feature equips you with the knowledge needed to maximize profits by staying on the right side of the market trend.

In addition, AlgoMap excels at uncovering reversal trade opportunities. It meticulously plots out entry points where the market may be poised for a reversal, allowing traders to seize moments of price reversals for optimal profits. With these reversal trade insights, traders can effectively anticipate and navigate market shifts, ensuring they are well-prepared to capitalize on price fluctuations.

With AlgoMap, you gain the upper hand in the trading world, as it delivers clear and data-driven entry and exit points, ultimately enhancing your trading precision. Whether you're a novice trader or an experienced pro, AlgoMap empowers you with the information you need to make well-informed trading decisions, increasing your chances of success in the ever-evolving financial markets.

What can you trade?

AlgoMap can be used to trade various financial instruments across different markets. Its capabilities extend to a wide range of assets, including:

1. **Stocks:** AlgoMap can be used to identify trading opportunities in individual company stocks, helping traders make informed decisions in the stock market.

2. **Forex (Foreign Exchange):** It provides insights into currency pairs, helping traders navigate the highly liquid and volatile forex market.

3. **Cryptocurrencies:** AlgoMap is versatile enough to analyze and generate trading signals for popular cryptocurrencies such as Bitcoin, Ethereum, and others in the cryptocurrency market.

4. **Commodities:** You can utilize AlgoMap to trade commodities like gold, silver, oil, and agricultural products by identifying trends and potential reversals.

5. **Futures Contracts:** It can assist in trading futures contracts in various asset classes, including stock indices, interest rates, and agricultural commodities.

6. **Options:** AlgoMap can be used to inform options trading decisions by offering insights into the underlying assets or indices.

7. **Bonds:** It can be applied to the bond market, assisting traders in making decisions related to government and corporate bonds.

8. **Exchange-Traded Funds (ETFs):** AlgoMap can help traders with ETF trading strategies, providing valuable entry and exit points for these diversified investment vehicles.

9. **Indices:** It is effective in analyzing and trading major stock market indices, such as the S&P 500, NASDAQ, and Dow Jones Industrial Average.

10. **Currencies and Cross-Currency Pairs:** In addition to forex, AlgoMap can be employed for trading currency pairs in other markets, like the cryptocurrency market.

AlgoMap's flexibility and adaptability make it a valuable tool for traders across various financial markets and asset classes. It leverages data and algorithms to generate insights and trading signals, helping traders make more informed decisions and potentially improve their trading outcomes. It's important to note that the specific assets and markets available for trading with AlgoMap may vary depending on the platform or software you use in conjunction with it.

Will AlgoMap Make you profitable?

AlgoMap, like other trading tools and algorithms, can be a valuable resource for traders, providing data-driven insights, entry and exit points, and trading signals. However, its effectiveness in making you profitable depends on several factors:

Your Trading Strategy: AlgoMap is a tool that assists with the execution of trading strategies. To be profitable, you need a well-defined and tested trading strategy. AlgoMap can help you implement your strategy more effectively by providing signals and identifying potential opportunities, but the profitability of your strategy depends on its underlying principles.

Risk Management: Profitability in trading is closely tied to risk management. AlgoMap can help you identify potential trades, but it's essential to manage risk through appropriate position sizing, stop-loss orders, and risk-reward ratios.

Market Conditions: Market conditions can vary, and no tool can guarantee profitability in all market environments. It's crucial to adapt your strategy and use AlgoMap's insights to match current market conditions.

Continuous Learning: Successful trading often requires continuous learning and adaptation. AlgoMap can be a useful part of your toolkit, but you should also stay informed about market news, trends, and developments to make informed decisions.

Psychological Factors: Emotions can significantly impact trading. Even with AlgoMap, it's essential to maintain discipline and emotional control to avoid impulsive decisions that could undermine profitability.

Backtesting and Optimization: Before relying on AlgoMap for live trading, it's advisable to backtest your strategy with historical data and optimize it to ensure it aligns with your trading goals.

In summary, AlgoMap can be a valuable aid in your trading journey, but profitability is not guaranteed solely by using the tool. It's your trading strategy, risk management, adaptability, and discipline that ultimately determine your success as a trader. Remember that trading carries inherent risks, and it's important to be prepared for both profits and losses. It's recommended to thoroughly understand AlgoMap and how it fits into your trading approach before relying on it for making trading decisions.

Can you trade Prop firms with AlgoMap?

Yes, you can potentially use AlgoMap as a tool to enhance your trading performance when trading with proprietary (prop) trading firms. To become successful and potentially the best trader within such a firm with the help of AlgoMap

How to use AlgoMap?

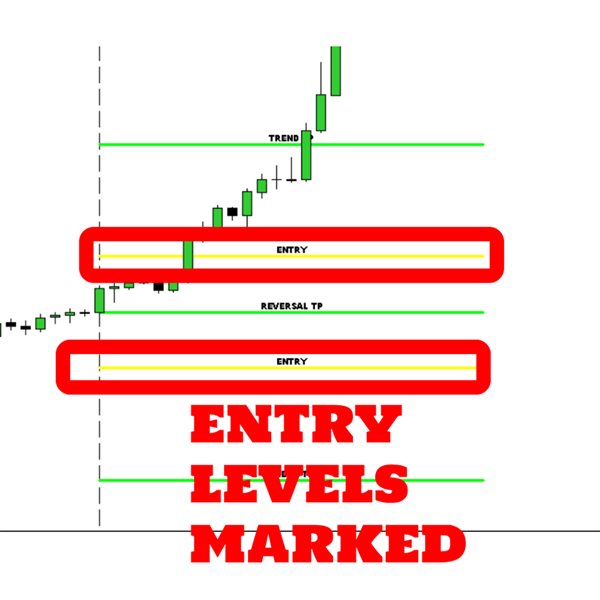

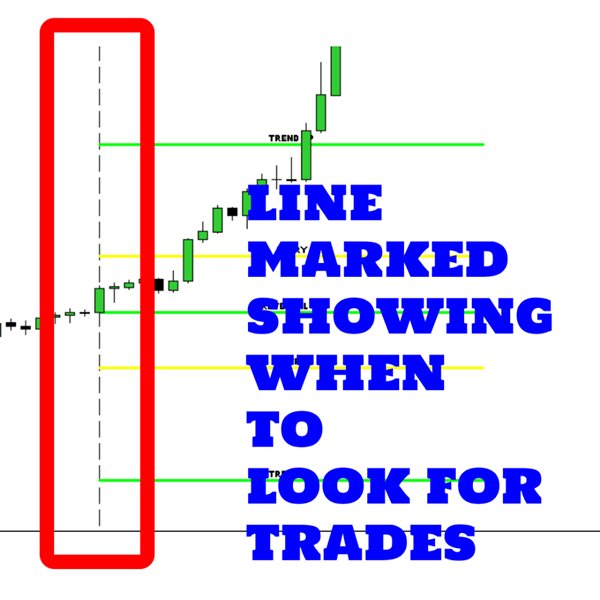

Using AlgoMap for trading decisions when price reaches an entry level marked by the tool is a straightforward process. Here's a simplified step-by-step guide:

1. **Access AlgoMap:** Log in to your trading platform or software that integrates AlgoMap. Ensure that you have the necessary data and access to the AlgoMap tool.

2. **Entry Level Confirmation:** When AlgoMap signals that the price has reached an entry level, carefully verify the signal and confirm its alignment with your trading strategy. This step is crucial to avoid impulsive decisions.

3. **Choose Your Trade Type:** Determine whether you want to take a reversal trade or a trend trade based on your trading strategy and the signal provided by AlgoMap.

a. **Reversal Trade:** If you decide to take a reversal trade, this means you expect the price to change direction. Look for reversal indicators or patterns, and set your stop-loss and take-profit levels accordingly. Ensure your risk-reward ratio is favorable.

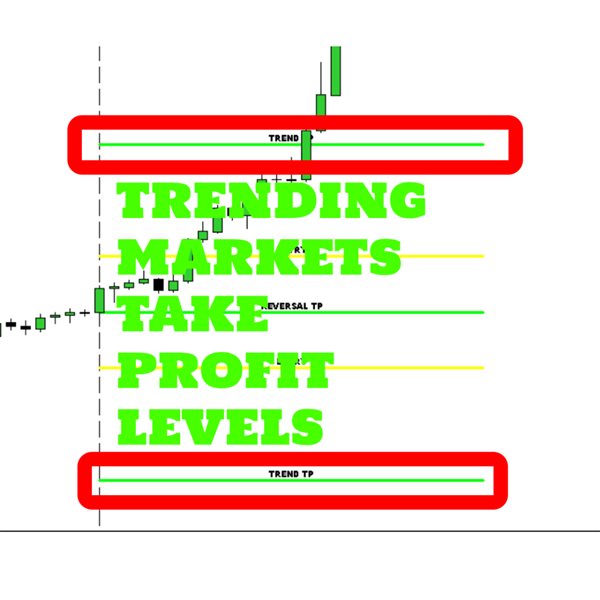

b. **Trend Trade:** If you opt for a trend trade, you believe the price will continue in its current direction. In this case, establish your stop-loss and take-profit levels to maximize potential profits while managing risk.

4. **Position Sizing:** Determine the size of your position based on your risk management strategy. This is important for controlling the amount of risk you are willing to take on the trade.

5. **Place the Trade:** Using your trading platform, place the trade according to the parameters you've set for your chosen trade type. Be sure to enter your stop-loss and take-profit levels.

6. **Monitor the Trade:** Once the trade is active, closely monitor the price movement, and be prepared to make adjustments if the market conditions change.

7. **Adhere to Risk Management:** Always follow your risk management rules. If the price reaches your stop-loss level, consider exiting the trade to limit potential losses.

8. **Take Profit or Reversal:** If the price reaches your take-profit level, execute the take-profit order. If you entered a reversal trade and the market confirms the reversal, you can exit the trade at an appropriate point.

9. **Review and Learn:** After the trade is complete, review your performance. Analyze the trade to identify what worked and what didn't. Use this feedback to refine your strategy for future trades.

It's important to remember that while AlgoMap provides valuable insights, no trading tool guarantees success. Your trading strategy, risk management, and discipline are key factors in achieving success in the markets. Make sure to thoroughly understand AlgoMap and incorporate it into your trading approach as part of a well-thought-out trading plan.