Introducing Ramona , the innovative trading bot inspired by the renowned figure in our trading community, RAJA Banks . Built on the smart Raja concept , Ramona specializes in breakout trading with stops at previous highs or lows. As we continue to expand our bot offerings, future bots will be developed based on strategies such as fakeout and continuation trades.

At the core of Ramona's philosophy lies risk management - a concept taught by RAJA himself. That's why Ramona incorporates all his teachings into its system, including stop losses at previous, current, and static levels. In time to come, even smarter stop loss mechanisms will be integrated for enhanced precision.

To further empower traders like you, Ramona features a comprehensive trade management tool that allows you to customize your trades according to your preferences. You can conveniently close partials,to manage risks effectively or take partial profits when opportunities arise. Moreover,a trade time filter is provided so that you have full control over when the bot executes trades.Additionally,the "minutes-to-trigger" feature ensures that only optimal setups are taken; avoiding immediate breakouts from previous highs. In fact, a safer market order setup upon new candle openings is also under development. So stay tuned!

Another crucial aspect emphasized by Raja is minimum trading range. Ramana takes this into account diligently,making sure there is sufficient range before initiating any trade. Finally,in an effort to safeguard trader interests, Ramana includes a prop firm protection filter. This intelligent feature halts trading after reaching predefined percentage or balance loss limits for each day. It prioritizes capital preservation while maintaining performance.

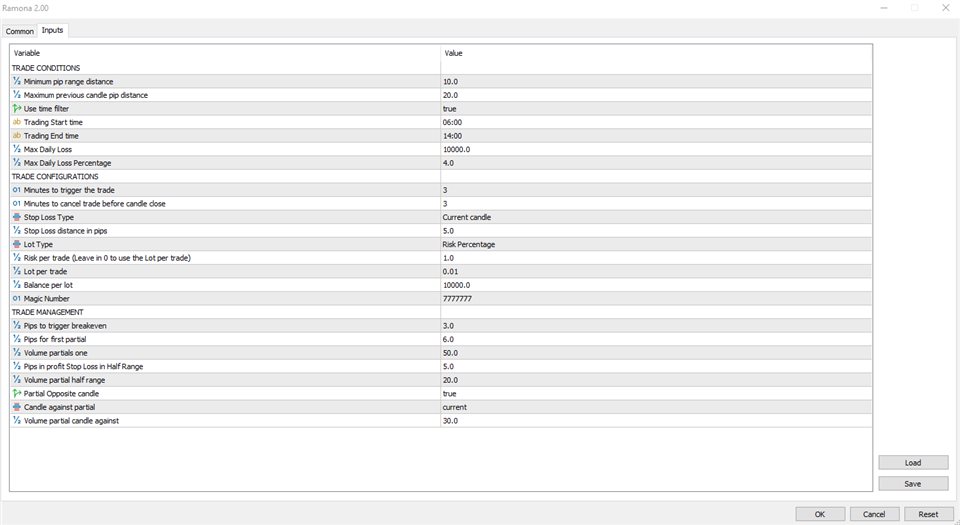

Let me explain each setting for you:

1) Min Pip range distance: This setting determines the minimum pip range required before Ramona initiates a trade. By specifying a minimum threshold, it ensures that trades are only taken when there is sufficient price movement to capitalize on potential breakouts.

2) Max Previous candle pip distance: With this setting, Ramona considers the maximum pip difference between the current candle and the previous one. It helps filter out trades that occur too close to recent highs or lows, aiming for more reliable breakout setups.

3) Time Filter: The time filter feature allows you to define specific trading hours during which Ramona will execute trades. You have full control over when the bot operates, enabling customization based on your preferred market conditions and personal schedule.

4) Max daily loss $: This parameter limits the maximum amount of money that Ramona can lose in a single day. By defining an acceptable monetary loss limit, you maintain strict risk management protocols and protect your overall capital from excessive drawdowns.

5) Max Daily loss %: Similar to max daily loss $, this percentage-based setting restricts how much of your account balance can be lost within a day's trading activity. It offers an additional layer of protection by limiting potential losses relative to your available capital.

6) Mins to trigger the trade: This configurable option specifies how many minutes need to pass after detecting a breakout setup before executing a trade. By adding this delay mechanism,Ramona aims for optimal entries while avoiding immediate reactions upon spotting new opportunities.This cautious approach prevents premature entries into potentially volatile situations without confirmation from subsequent price action movements.

7) Mins to cancel trade before candle close: This feature allows you to specify the number of minutes before the current candle closes, within which Ramona will automatically cancel any open trades. It helps prevent unnecessary exposure and potential losses when market conditions change rapidly or show signs of reversing.

8) Stop loss type (Previous candle, current candle, Static Stop loss): With this setting, you can choose the type of stop loss mechanism that Ramona employs. The options include using the high or low of either the previous candle or the current one as reference points for placing a stop-loss order. Additionally, there is also an option for a static stop-loss value that remains fixed regardless of price movements.

9) Risk type (% balance and fix lots): This selection determines how risk is managed in terms of position sizing. You have three choices: percentage-based risk management based on your account balance; fixed lot sizes where positions are opened with predetermined volume; or a combination where both methods are utilized simultaneously.

10) Pips to trigger be: By specifying this parameter, you set up a certain pip distance from entry at which point Ramona will move its initial protective stop order to break-even level. Moving stops into profit after reaching breakeven helps reduce downside risks by securing some profits even if subsequent price action reverses against an entered trade initially.

11) Pips for first partial: This setting enables customization regarding partial profit-taking strategies employed by Ramona. Here,you indicate how many pips need to be achieved before initiating partial closure of the original position size.This approach locks in profits while keeping remaining portions exposed to further upside potential during favorable market conditions.

12) Volume close for partial 1: Using this parameter,you determine what proportion of your initial position should be closed upon reaching "pips for first partial."By adjusting this value,Ramona offers flexibility in choosing to secure smaller or larger portions of profits when partial closure is initiated.

13) Pips in profit stop loss in half range: This setting allows you to define the number of pips at which Ramona will adjust its stop-loss order, moving it to a level halfway between the entry point and current price. By doing so, this mechanism aims to lock in additional profits as trade moves further into favorable territory.

14) Volume partial half range close: Similar to 'Volume close for partial 1,' this parameter determines what proportion of your remaining position should be closed upon reaching 'pips in profit stop loss in half range.' By adjusting this value, you can decide how much of your remaining position you want to secure as profits when the trade moves further into favorable territory.

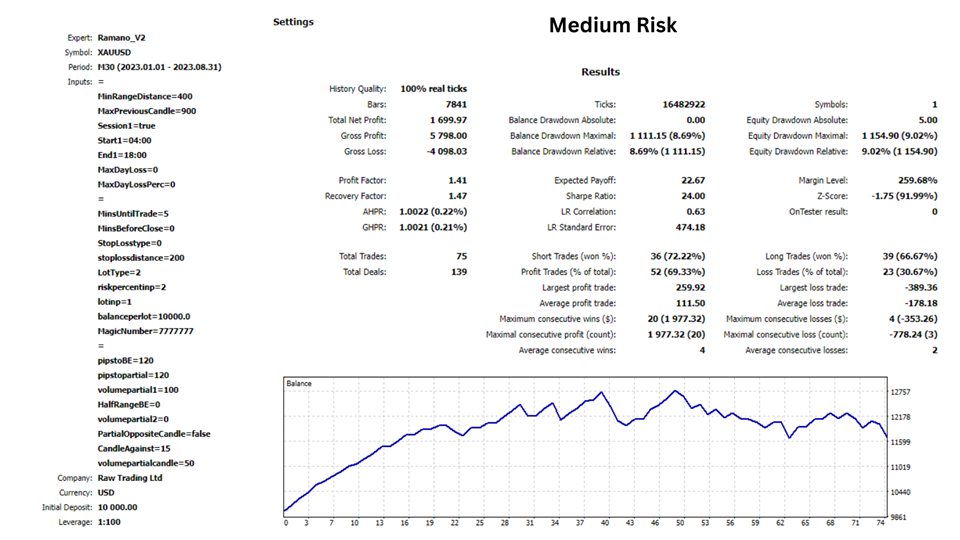

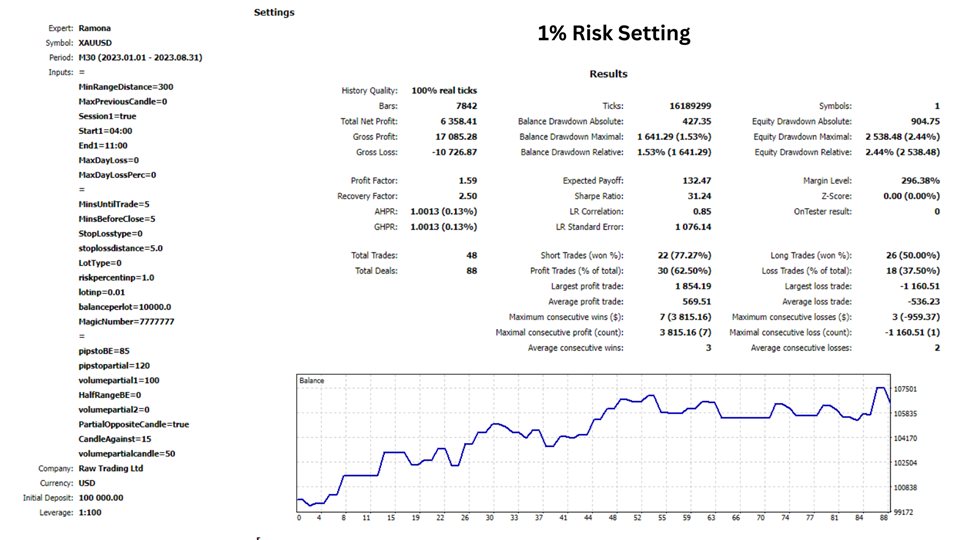

Recommended Setting are screenshot with results.

Please Note : Default setting that comes with the bot are not the best settings.