Gold mid-trend intraday scalper with exceptionally conservative risk management to succeed in prop firm environment

NEW VERSION 1.01: Fixed a reported issue with lot size on some brokers due to irregular tick_value

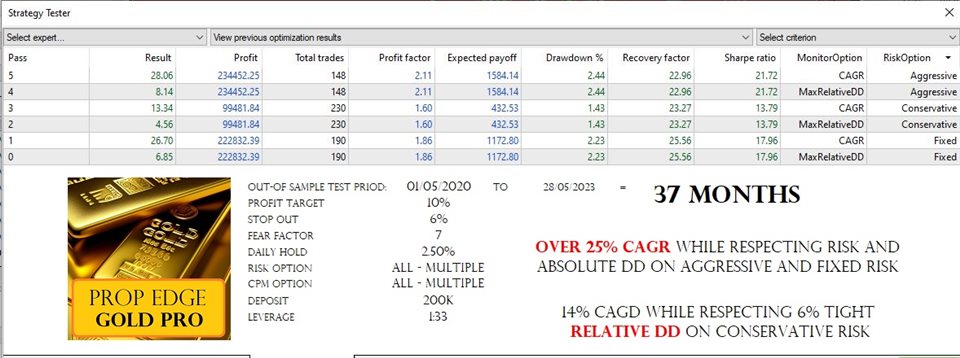

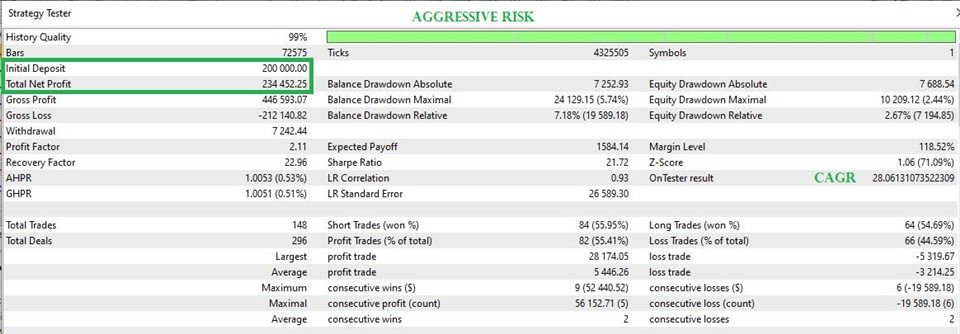

- EA manages risk to respect the allowed absolute DD on aggressive risk option

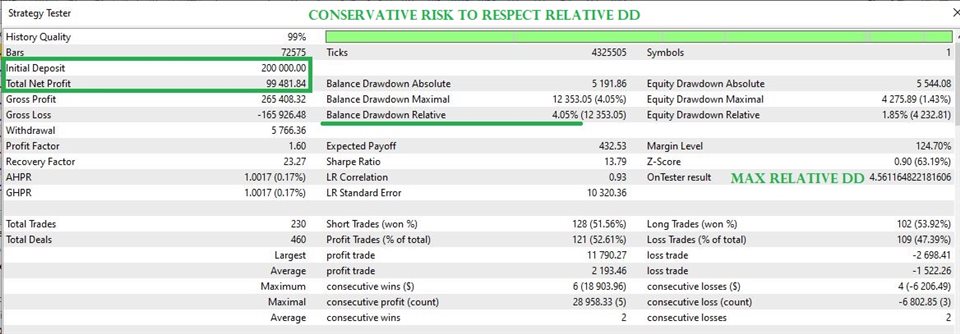

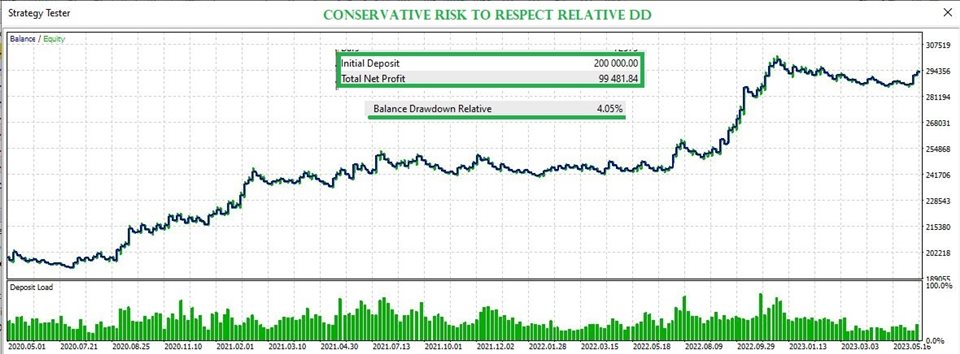

- EA tightens the risk to minimize relative DD on conservative risk option

- EA can use fixed risk option for non-prop traders to manage their own risk

- I am told it can be optimized, but I do not want to "curve fit" so I leave it as I use it

- If you are on an account up to 50k, you should look at Prop Edge Gold 50

- For accounts over 50, you are welcome to demo this EA and see if you like the.

- Then you rent it for 1 month to confirm that the performance is there.

- Then you rent 6 month or buy keep rolling prop firm's stages and scale up.

General EA marketplace advice:

- Never rent before you demo

- Never buy before you rent

- Never use on a prop firm an EA that shows over 5% Max DD unless they let you

- Never use on a prop firm an EA that shows over 10% Relative DD unless your test period is multiple years long

- Never trust backtest results with under 100 trades since it is not statistically significant - just test for longer period

Not suitable for:

- 30, 60 or 90 day challenges

- brokers where XAUUSD is regularly over 25 point spread

- Accounts under 5 leverage (due to lack of margin)

Suitable for:

- Blue Guardian - Unlimited

- CTI - Instant Funding

- CTI - Direct Funding

- Finotive Funding - Challenge

- FTUK - Instant Funding

- FTUK - Evaluation

- Funded Academy - Extended

- Funded Trading Plus - any program

- MyForexFunds - Rapid

- MyForexFunds - Evaluation

- the5ers - Instant Funding // Hyper Growth

- the5ers - Bootcamp

- Traders With Edge - Turtle

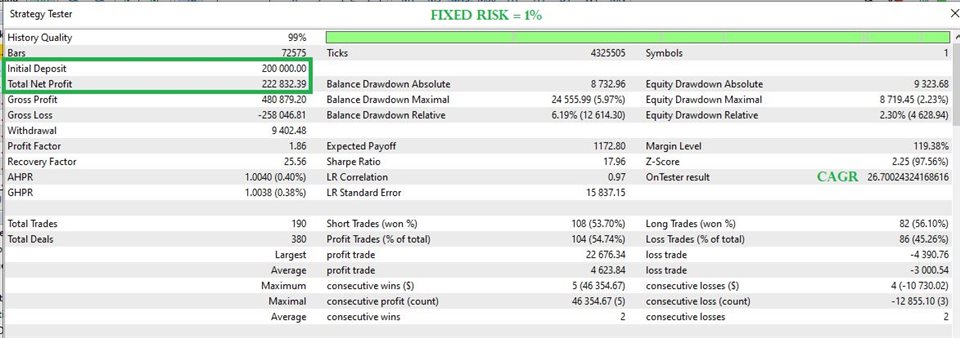

Scale up any of these in 4 to 6 months. My suggestion is to keep 3 of those and scale them all.This EA is an update of my old MT4 EA, which I had to create when my prop firm announced they would be disabling MT4 down the road in favour of MT5. Since this EA is meant to use on prop firm environment, equity conservation is of higher priority than quick profit at any risk. Risk management is the true edge of this EA.

This EA is meant for prop traders like myself with multiple accounts of different sizes on different firms, with one digit max drawdown and not a rushed schedule of 30, 60 or 90 days to hit profit target. For smaller accounts up to 50k there is the cheap version of this EA called Prop Edge Gold 50 which works 100% the same way but with equity scaled down to 60k (to allow 50k start to grow 20% before scaling cutoff).

Unfortunately most EAs on the market manifest a 10% to 35% max drawdown which is not at all permitted on a prop firm environment. Even most EAs named "Prop" fail due to what prop firms consider a drawdown violation.

This EA generates enough profit to reach profit targets up to 10% in 3 to 6 month without any risk or drawdown violation. It is enough to scale up prop firm accounts two to 3 times per year. If your prop firm requires low relative drawdown, make sure you use the "Conservative" risk option.

Backtest instructions:

Make sure you set account size, leverage and XAUUSD on the tester;

Mandatory Configs: Initial AUM Balance, Profit Target, Stop Out and Risk Option;

I recommend running 2-3 years to make it statistically relevant;

Everything else is either optional or I recommend leaving alone;

Future version plans:

- add more CPM if/when requested on the comments