Title

THE FOREX BANK TRADING STRATEGY

Description : The Forex Bank Trading Strategy is designed to identify where the largest market participants are likely to enter or exit their position based on areas of supply and demand.

We term these levels as ‘manipulation points’.

the top 10 banks control well over 60% of the daily forex market volume. Because of this, when they move in and out of the market, the market moves!

STEP #1 - ACCUMULATION

Accumulation: Because of the massive volume banks control they must enter positions over time that often show visibly as range-bound or sideways price action.

We call this accumulation as they are areas where smart money frequently enters or ‘accumulates’ their desired position over multiple hours or longer.

As their primary function is making the market, they make money by accumulating a long position that is later sold off at a higher price or accumulating a short position they will later cover or buy back at a lower price.

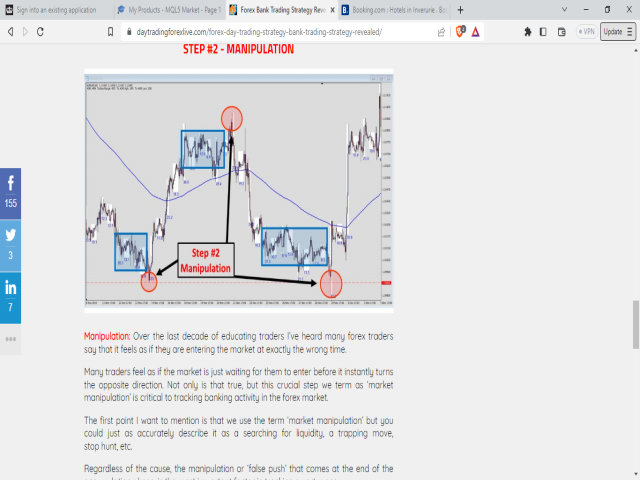

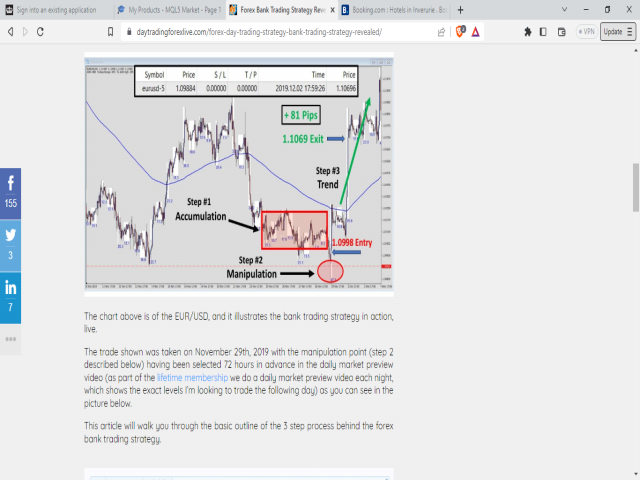

STEP #2 - MANIPULATION

Manipulation: Over the last decade of educating traders I’ve heard many forex traders say that it feels as if they are entering the market at exactly the wrong time.

Many traders feel as if the market is just waiting for them to enter before it instantly turns the opposite direction. Not only is that true, but this crucial step we term as ‘market manipulation’ is critical to tracking banking activity in the forex market.

The first point I want to mention is that we use the term ‘market manipulation’ but you could just as accurately describe it as a searching for liquidity, a trapping move, stop hunt, etc.

Regardless of the cause, the manipulation or ‘false push’ that comes at the end of the accumulation phase, is the most important factor in tracking smart money.

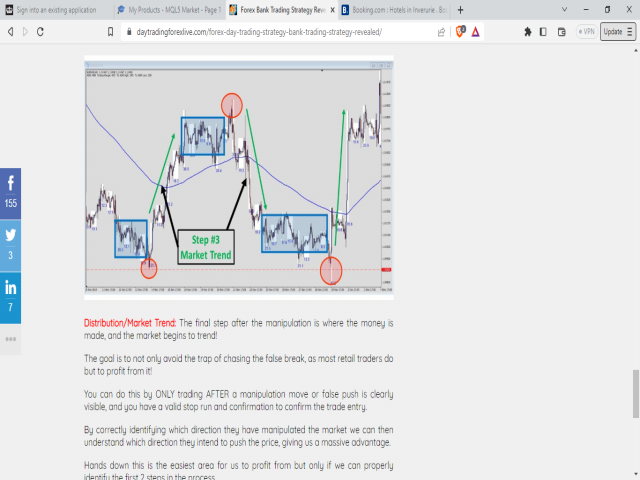

STEP #3 - MARKET TREND

Bearish: A stop run or false push beyond the high of an accumulation period likely means that smart money has been SELLING into the market, and a short-term trend in that direction is likely to start.

Bullish: A stop run or false push beyond the low of an accumulation period likely means that smart money has been BUYING into the market, and a short-term trend in that direction is likely to start.

This point, both bullish and bearish is illustrated in the second picture above. As you can see the manipulation comes after the accumulation, and it often occurs right before step #3 begins, the market trend.

Distribution/Market Trend: The final step after the manipulation is where the money is made, and the market begins to trend!

The goal is to not only avoid the trap of chasing the false break, as most retail traders do but to profit from it!

You can do this by ONLY trading AFTER a manipulation move or false push is clearly visible, and you have a valid stop run and confirmation to confirm the trade entry.

By correctly identifying which direction they have manipulated the market we can then understand which direction they intend to push the price, giving us a massive advantage.

Hands down this is the easiest area for us to profit from.

Time Frames and Pairs

5M 15M 30M 1H All Forex Pairs Crypto and Metals