General

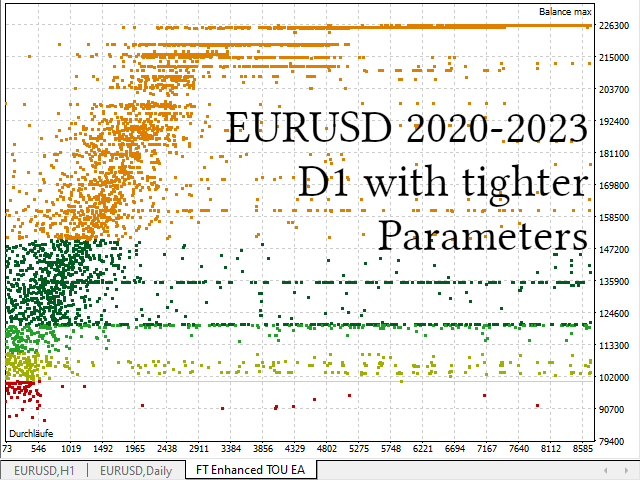

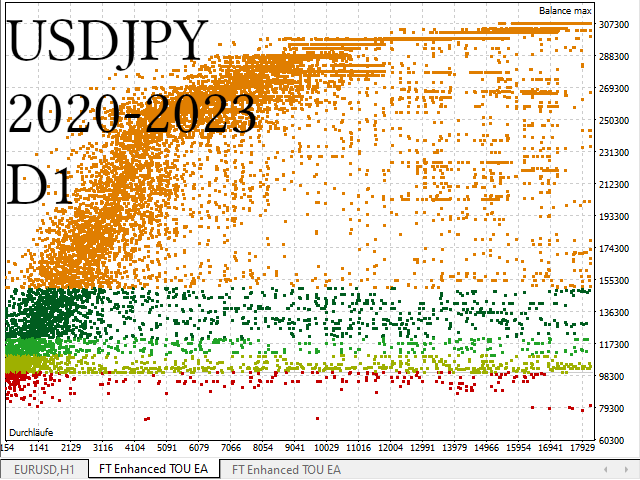

This expert advisor combines the strengths of eight indicators. Among them is the Trending Ornstein-Uhlenbeck indicator. This is based on a further development of the Ornstein-Uhlenbeck process, which is one of the most important stochastic differential equations. Not only the white noise of the market but also support and resistance areas as well as different market phases are examined, evaluated and weighted. This Expert Advisor contains a variety of parameters through which the user has the control to eliminate unprofitable sub-strategies and increase the trading volume for promising sub-strategies. Of course, the parameters must be adjusted depending on the time frame and symbol used.

Parameters

- Period: The number of values (e.g. bars) to be used for the analysis data.

- Deviation: The deviation with which the market phase is determined.

- Barrier: The relative barrier strength from which an area is considered as a support or resistance area.

- The "Factor" parameters of the "Calculation" section indicate with which weight the slope, the pattern accuracy, the oscillators, the regression values, the resistance areas and the market phase are included in the different calculations of the sub-strategies.

- The "Min. strength" parameters of the "Trade settings" section indicate the strength that a trend, a break-through, a pullback, a trend reversal and a mean-reversal must have in order to be considered a (long) buy or a (short) sell signal.

- Confidence: If this parameter is set to "true", we are long in the market if the sum of the signals is positive. If this parameter is set "false", we are long in the market if there are buy or hold signals, but no sell signals. The same is true for short.

- Hold tolerance: This parameter specifies the tolerance with which an open position should be held. For example, a tolerance of 0% means that we hold a long position only if there is a buy signal. A tolerance of 100% means, for example, that we hold a short position until there is an exit or a buy signal.

- Risk (%): The maximum risk with which a position may be opened.

- The "Factor" parameters specify the factor by which the lot size should be multiplied. For example, a factor of 0 for "long trend factor" means that long trends are not traded. A factor of 0.5 means that they are traded with half the lot size.

- Max. slippage: The maximum slippage with respect to the desired trade value, which should be allowed for the orders sent. (Not every broker will consider this value).

- Stop Loss multiplier: Specifies the maximum amount of the stop loss measured against the ATR (Average True Range). The stop loss also takes into account the maxima and minima of the market phase and the support areas.

- Stop-Loss type: Specifies the behavior of the stop-loss: Fixed, BreakEven, Trailing.

- Take-Profit multiplier: Specifies the maximum level of the stop loss measured against the ATR. The take-profit also takes into account the maxima and minima of the market phase and the resistance areas. This parameter must be at least twice the stop-loss multiplier.

- Strategy ID: The unique identifier of the strategy, which is needed to identify open positions of the EA after a system crash.

Explanation

The price trend of the market depends on the microeconomics in short periods of time and on the macroeconomics of the stock market in long periods of time. Stable trends are more likely to occur in the time scale of the macroeconomy, since it depends significantly on the economy, which does not change seriously every second or minute. This EA is flexible enough to take stable movements or to trade short term movements depending on the parameter settings.

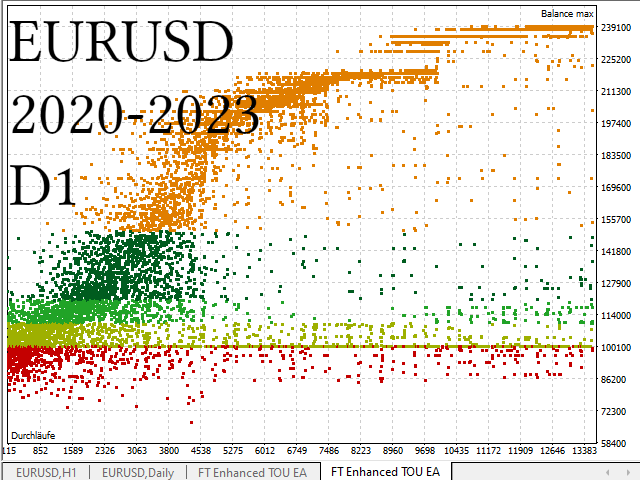

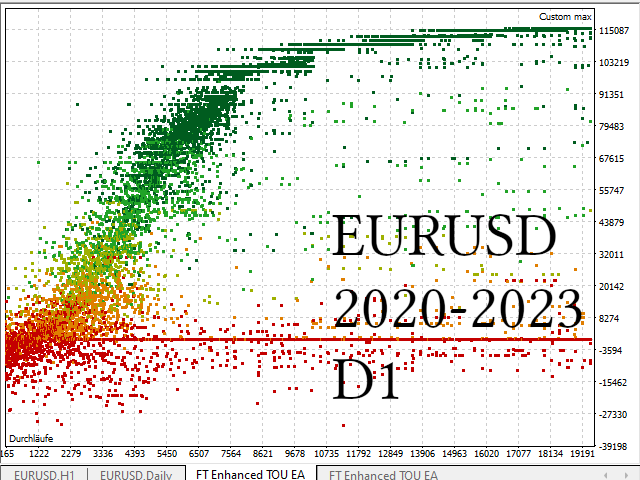

Since the market situation will change over time, it is necessary to adjust the parameters of the EA from time to time. Therefore I recommend to recalibrate the parameters of the EA every week or at least every month based on an optimization over the last months.

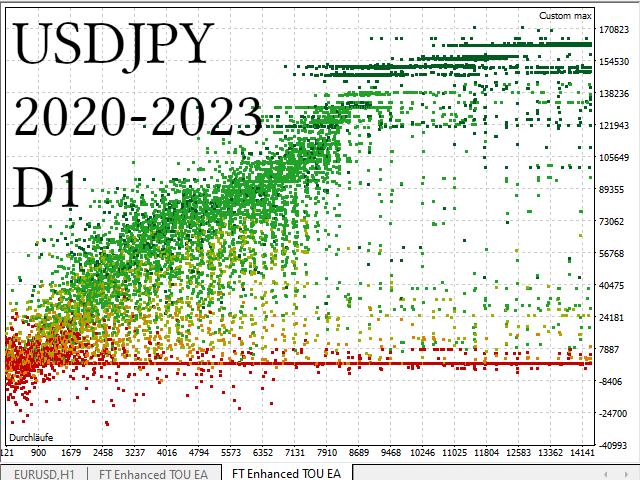

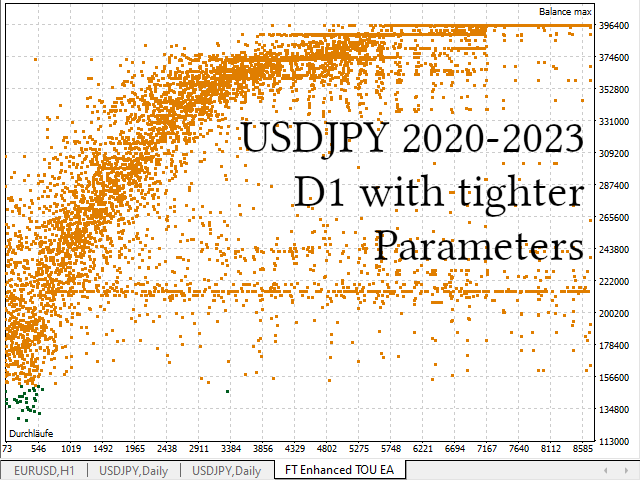

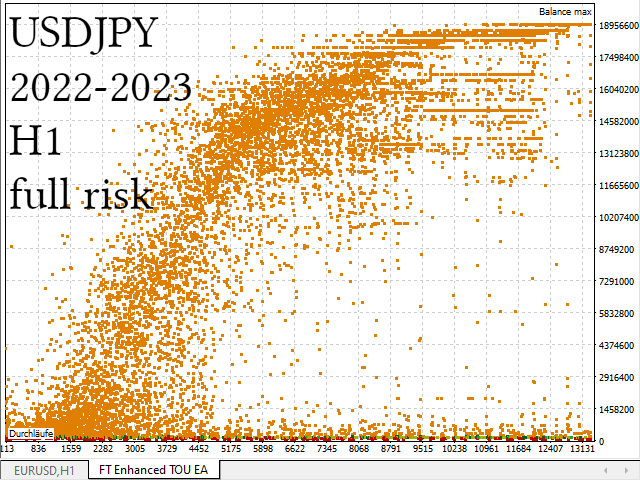

Note: Bad parameters lead to bad results. Therefore I recommend to start with a genetic optimization and to check the ranges around promising parameter constellations with a full optimization and then to use a value of a profitable and stable range for the next days, until the next optimization. For the optimizations I recommend the specially implemented criterion "Custom max".