General

This Expert Advisor combines the strengths of linear and polynomial regression analysis and combines them with some additional indicators. This Expert Advisor considers two trading options: 1) To follow the current trend. 2) To trade a correction or an expected market reversal.

Parameters

- Period: The number of values (e.g. bars) to be used to determine the market phase, fair price, fair slope and their standard deviations.

- Deviation: The deviation with which the market phase is determined.

Trend parameters

- Min. strength: Minimum strength of the significant fair slope from which the respective setup should be traded.

- Min. accuracy: Minimum accuracy of the determined values, from which the respective trend setup should be traded.

- Confirmation: This parameter can have the values Low, Normal and High. It indicates how strong the long or short trend signal must be confirmed by other indicators.

Reversal paramete

- Min. strength: Minimum strength of the significant fair slope, from which the respective setup should be traded.

- Accuracy: The accuracy of the setup structure at which the respective reversal setup should be traded.

- Type: The type of reversal to be traded: Pullback, MeanReversion, TrandReversal, All.

- Mode: The mode of the setup specifies which slope should be paid special attention to: Any, Linear, Exponential, Complete.

Money Management

- Risk (%): The maximum risk with which a position may be opened.

- Factor: The factor parameters specify the factor by which the lot size should be multiplied. A factor of 0 for e.g. LongTrendFactor means that long trends are not traded. A factor of 0.5 means that they are traded with half the lot size.

- Max. slippage: The maximum slippage with respect to the desired trade value, which should be allowed for the orders sent. (Not every broker will consider this value).

- Stop loss multiplier: Specifies the amount of stop loss measured against the stop loss base type.

- Stop-Loss type: Specifies the stop-loss base type to be used: FixATR, FixZZ, TrailingATR, TrailingZZ, FixCompound, TrailingCompound.

- Strategy ID: The unique identifier of the strategy, which is needed to identify open positions of the EA after a system crash.

Explanation

The price development of the market depends on the microeconomy in short time periods and on the macroeconomy of the stock market in long time periods. Stable trends are more likely to occur in the macroeconomics time frame, as it depends largely on the economy, which does not change seriously every second or minute. Since this EA needs stable movements to work cleanly, the combination of the Period parameter and the time base of the chart on which the EA is running should be chosen so that the resulting time period does not belong to the microeconomy of the market.

Since the market situation will change over time, it is necessary to adjust the parameters of the EA from time to time. Therefore I recommend to recalibrate the parameters of the EA every week or at least every month based on a complete optimization over the last months.

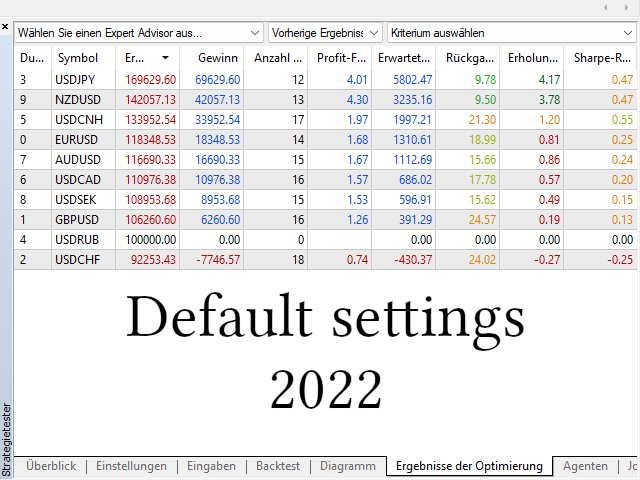

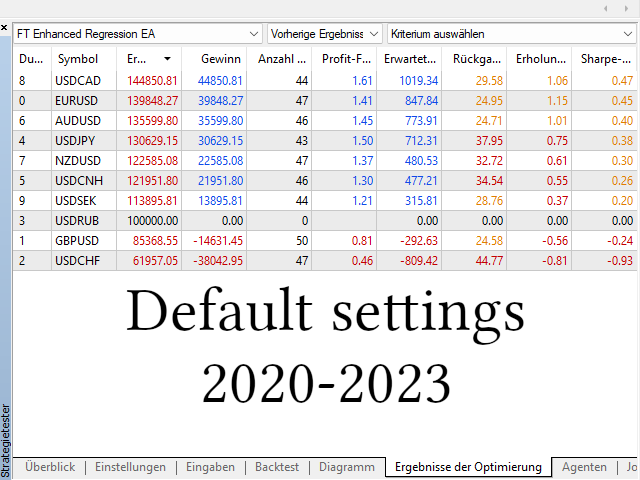

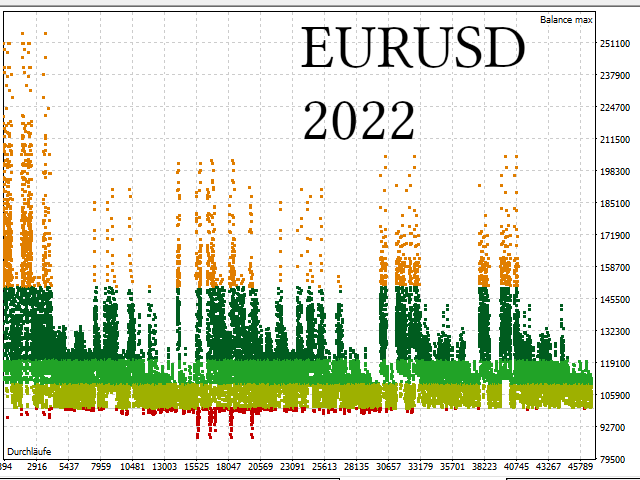

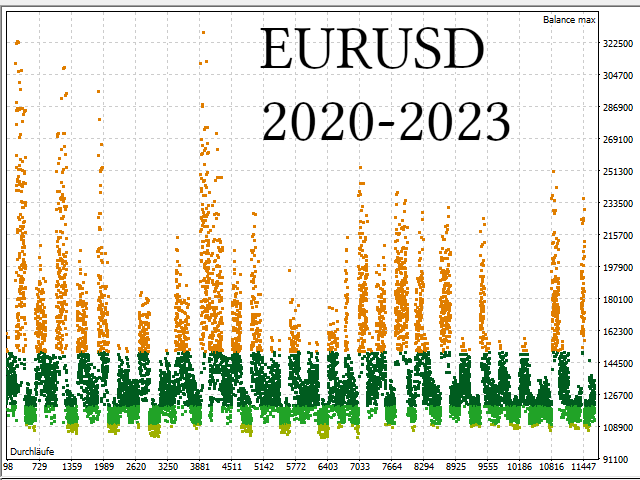

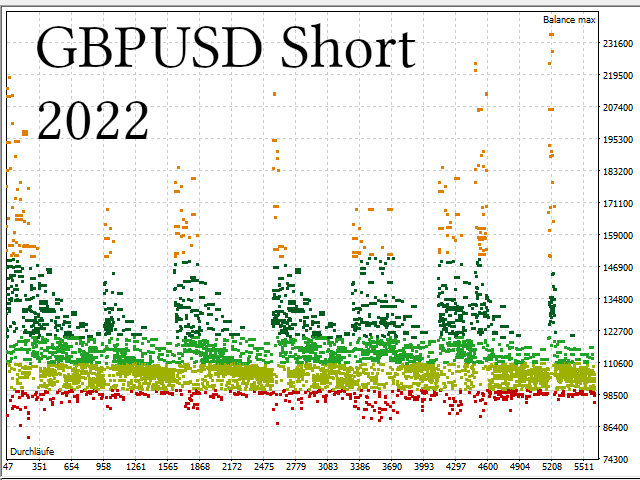

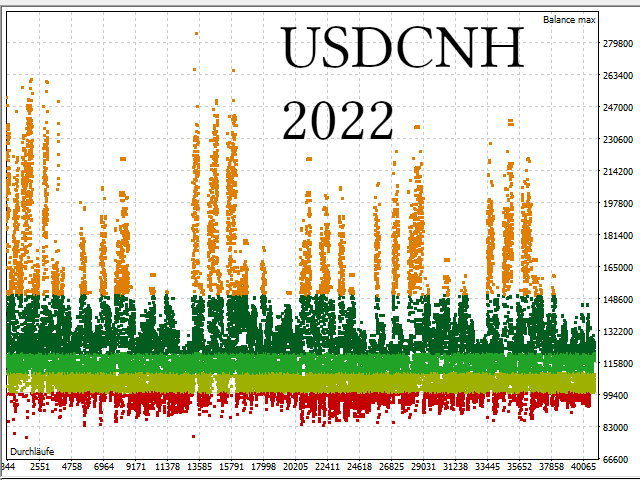

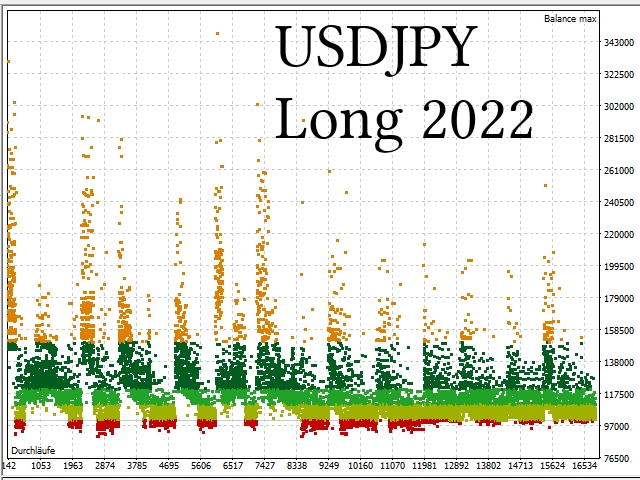

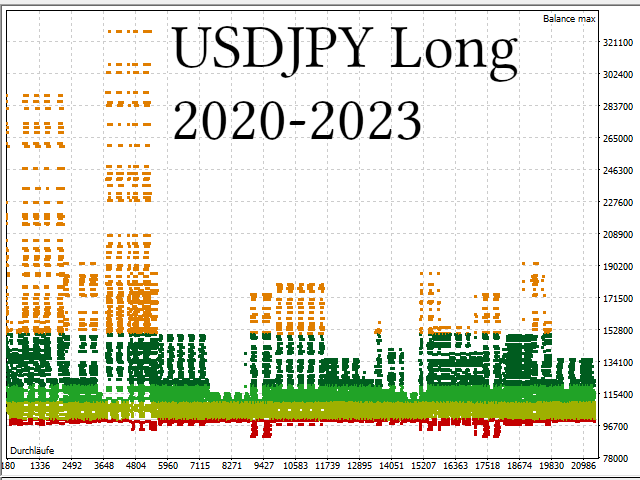

Note: Bad parameters lead to bad results. To show that there are whole mountain ranges of good parameters, I have attached as screenshots the results of complete optimizations with the default parameters or an optimization around them.