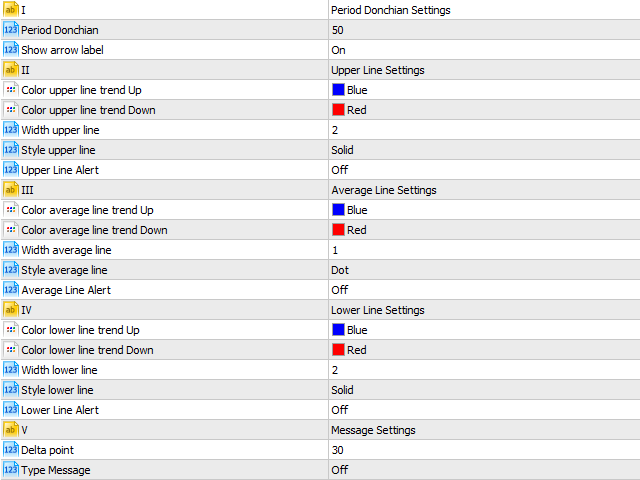

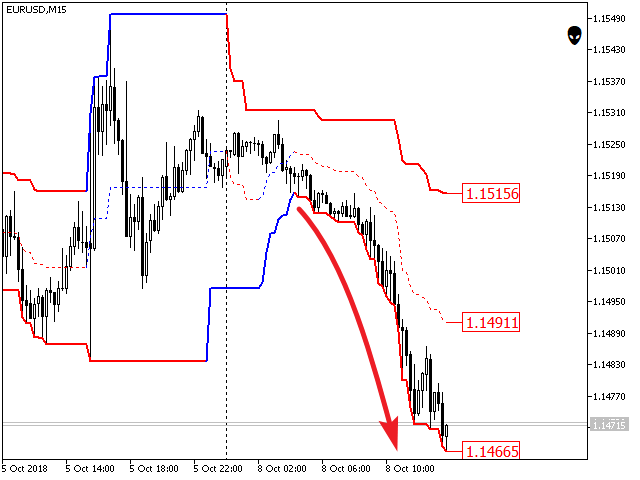

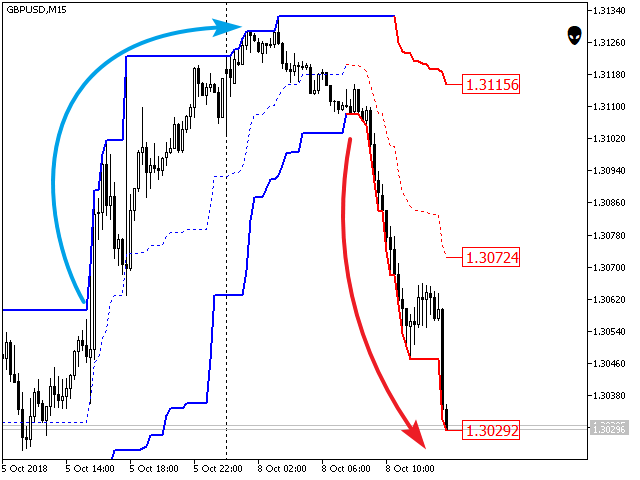

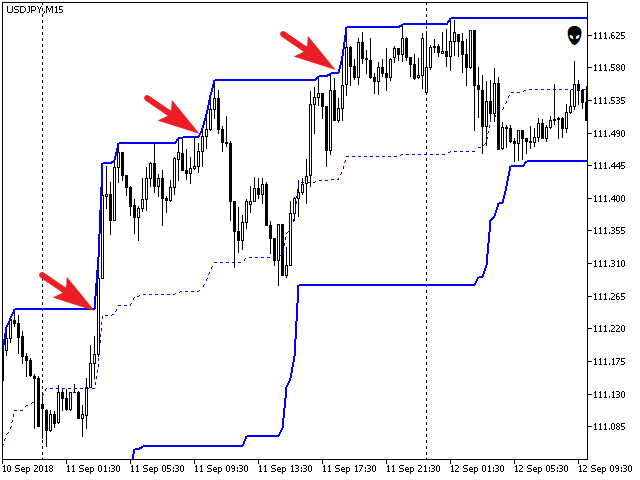

The VR Donchian indicator is an improved version of the Donchian channel. Improvements have been made to almost all channel functions, but the basic algorithm and channel construction have been preserved. The indicator now changes the color of the levels depending on the current trend - this clearly shows the trader a change in the trend direction or flat. The ability to inform the trader about the breakthrough of one of the two channel levels via smartphone, email, or in the MetaTrader terminal itself was added as well. Price tags have been added that allow the trader to see the prices of the levels on the chart.

The algorithm of the classic Donchian indicator has been optimized and accelerated due to the fact that the trader can set the number of periods for the indicator to calculate himself. The classic Donchian indicator calculates the entire history available in the MetaTrader terminal, which heavily burdensThe MetaTrader terminal with mathematical calculations. The VR Donchian indicator only calculates the amount that the trader has set, which reduces the load on the MetaTrader terminal by tens or even hundreds of times.

The rule of trend detection:

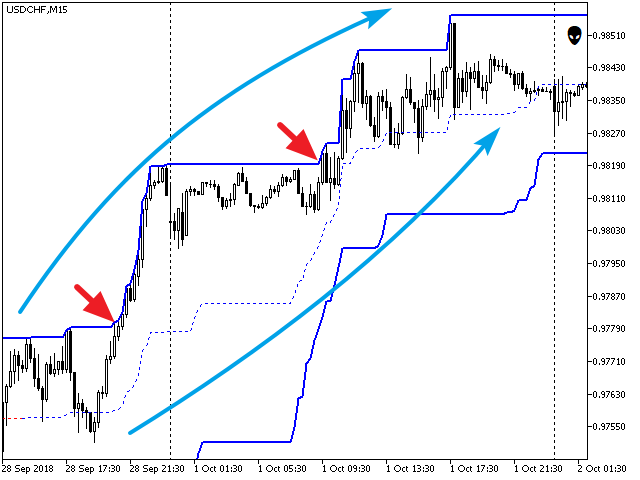

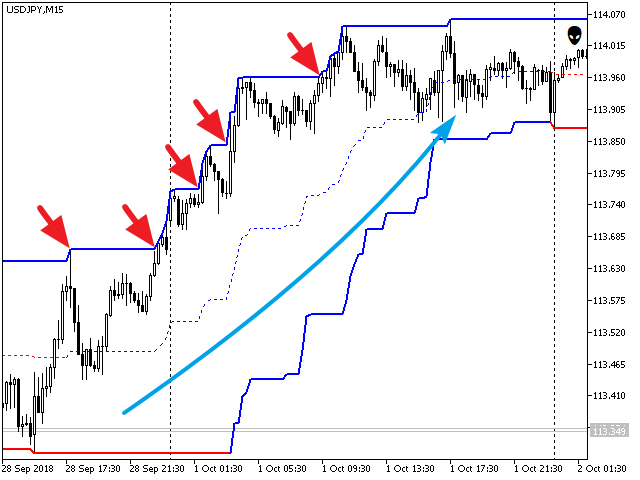

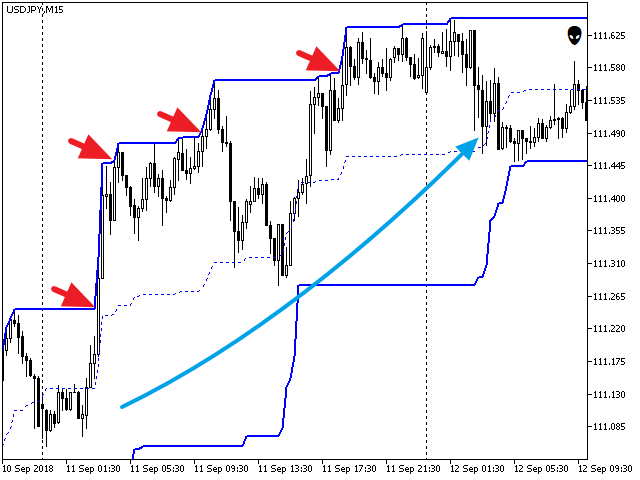

- If a new local high is higher than the previous one and a new local low is higher than the previous one, it is considered that the trading instrument is in an uptrend.

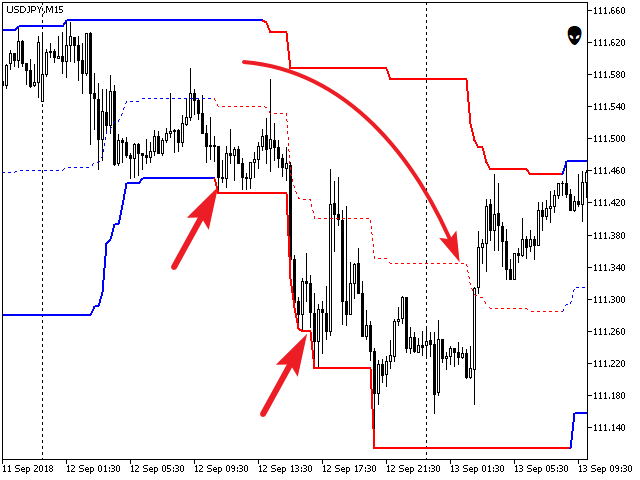

- If a new local high is lower than the previous one and a new local low is lower than the previous one, it is considered that the trading instrument is in a downtrend.

- If we cannot apply any of the two rules described above to the current trend it is considered that there is no certainty on the trading instrument - it has entered flat.

Advantages

- It is one of the most accurate indicators displaying channels.

- The ability to receive messages via alert in the terminal, push-message to your smartphone, and email.

- It is suitable for any financial instrument: Forex, Crypto, CFD, Metalls.

- The indicator is not redrawn.

- It is easy to install - just drag it over the chart.

- It works in the strategy tester, on demo accounts, and on real accounts.

- It is suitable for both beginners and professionals, the indicator is based on classic trading rules.

- A large number of settings allow you customize the indicator to your liking.

- The indicator can transmit the signals by standard methods via buffers and using global variables of the terminal.

- There are two versions - for the MetaTrader 4 and MetaTrader 5 terminals.

Recommendations

- The longer is the period for which you use the indicator, the more accurate its readings will be and the larger the trend can be expected.

- Combining the indicator with your trading strategy will increase the probability of success and reduce the likelihood of losses.

- Avoid moments of uncertainty and trading on the news.

- Select the indicator period based on the last uncertainty zone. Set up such a period that there would be no false trend readings in the zone of uncertainty.

- Use multiple copies of indicators with different periods, such as the period of the first indicator 21 and the period 48 of the second indicator.

- Buy when the upper level is broken and sell when the lower level is broken, good signals are obtained when the price breaks through several lines of different indicator periods at the same level.

- Do not use yield statistics constantly, we recommend to use it only in the selection period or for analyzing new financial instrument.

Versions: MetaTrader 5

More information in the blog go to

Your feedback is the best gratitude for us! Leave feedback.

Technical support, configurations, set files and trial period can be requested in chat group