Follow live performance:

Aggressive settings:

https://www.mql5.com/en/signals/564559

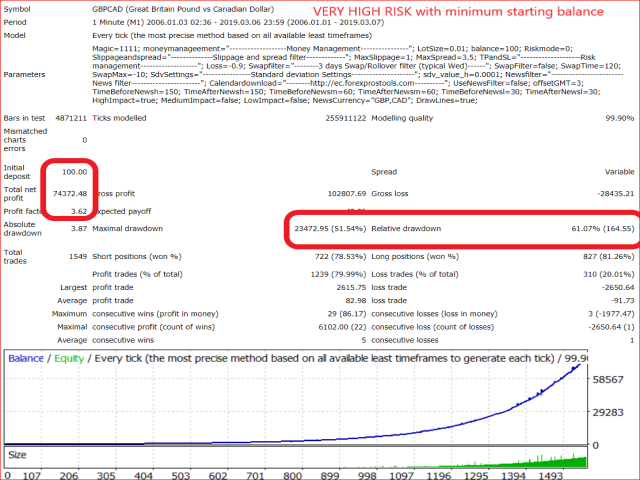

Revolutionary hybrid grid: more than 13 years backtest with starting balance as low as 100 dollars - VERY IMPORTANT TO BACKTEST DEMO: please read backtest instruction or ask via PM.

Description:

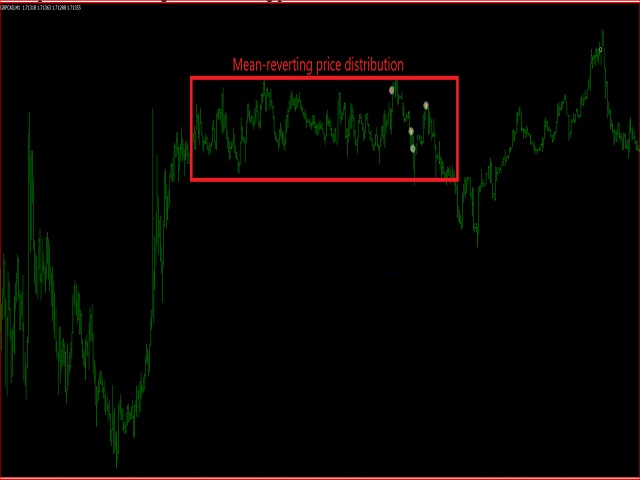

The HIBgRID is a Hybrid Grid EA based on the mean-reverting characteristics of the pair GBP/CAD during low volatility and low volume period.

The EA utilizes the mathematical principles of a Ornstein–Uhlenbeck process to identify trades with success probability higher than 85%.

After a trade is opened the EA will calculate a target profit and close the trade.

In case the price behaviour is unfavorable the Risk Manager will close the trade at a lower profit target or even with a small loss.

If the Risk Manager does not identify evidences of a non mean-reverting time serie the EA will open recovery orders up to a maximum of 5 open orders.

The EA utilizes a proprietary grid logic with light lot size increments in order to minimize drawdown and risk exposure.

Live performace results differ may from backtest because- Signal is stopped during major BREXIT news (precaution)

- Signal uses news filter (not working in backtest)

- Signal uses 3 days swap fileter

- A tick system on live account will never match exactly backtest although 99.9%

For more info on EA and parameters visit https://www.mql5.com/en/blogs/post/725139

What is a Hybrid Grid:

- As opposed to stabdard grid the EA closes some trades with a loss under certain higher risk conditions

- Grid orders can be closed with a TP and reopened

Requirements:

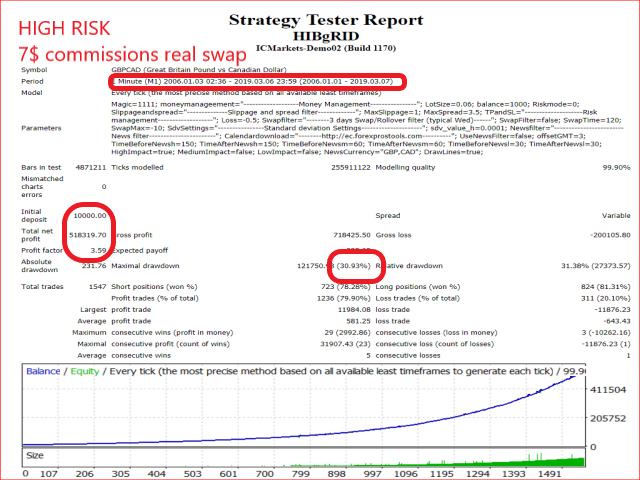

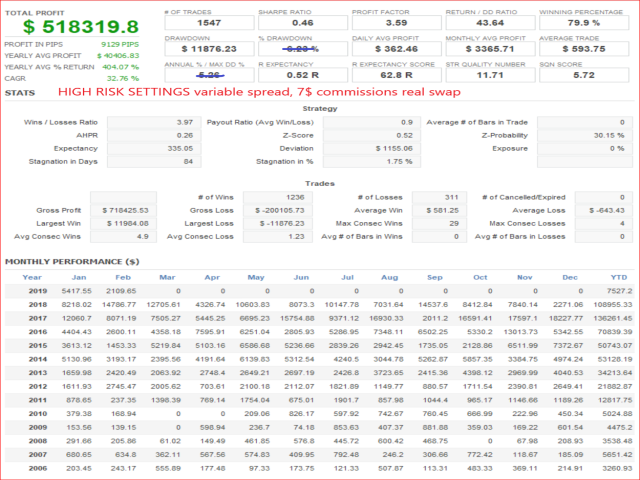

The minimum investment is 100 Dollars with Very High Risk. 300 dollars for standard settings.

It is STRICTLY MANDATORY to use a true ECN account with low spread on GBPCAD during early Sydney session. IC Market is used as a reference for backtest. See blog for more info

Parameters:

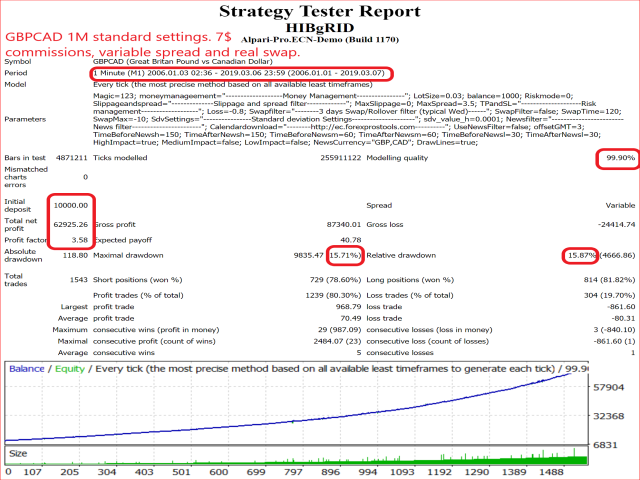

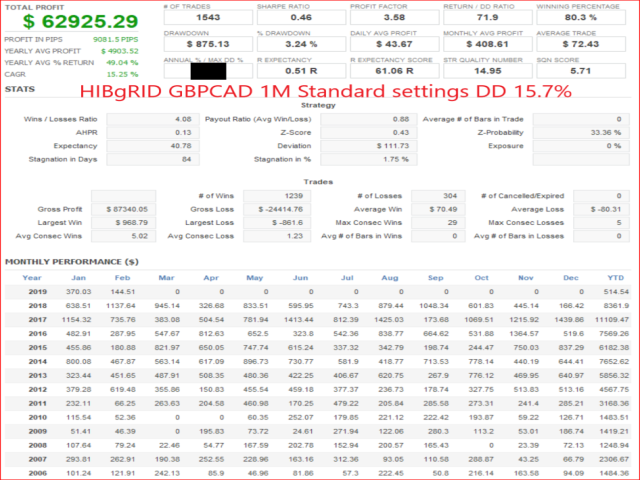

Standard setting for GBPCAD 1M

Broker GMT offset: 0. Leave 0 for NY close broker GMT + 2 or + 3 during DLS (ICMarkets, Axitrader, Darwinex etc)

Lot size: Standard settings 0.03.

For balance: Standard settings: 1000. Balance used to calculate lot size.

Max allowed Draw Down Standard settings -0.25 as a factor of the current balance. In case the equity drops below this threshold the EA will close all orders as a capital protection measure. As en example, balance is 10.000, Max allowed draw down is -0.2, this means that if the equity goes below 8.000 the EA will close all open orders. VERY IMPORTANT: respect the standard ratio Lot/MaxDD: If your want to set your max risk at 10%, then use 0.01 lot per 1000 and max draw down -0.1.

3 days swap/rollover filter It is recommended not to trade against the three days rollover (usually between Wednesday and Thursday night for the majority of brokers).

Backtest:

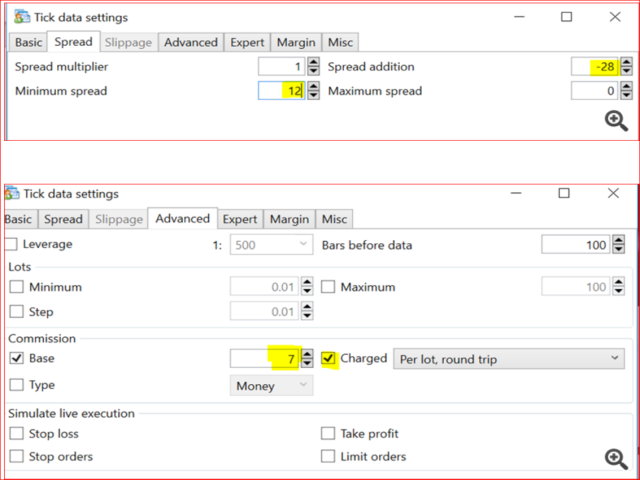

As the spread plays an essential role in the real performance and it is used also as a volatility filter especially before rollover/swap charge and during strong price movement, only a tick by tick, 99% accuracy variable spread test has a statistical meaning. Please avoid testing with fixed spread as it is worthless.

My backtests use Dukascopy data with a negative cap of 27 points and minimum of 12 points, 7 dollars round trip and real swap. This is the closer to the best ECN broker real conditions. Dukascopy spreads are too large for this strategy

Money Management and risk warning:

This EA is suitable for patience and non greedy investors capable to deal with potentially large drawdowns.

Although the backtest surpassed 13 years without a major loss (99% accuracy, variable spread, 7 Dollars round trip commission and current swap), like any grid system the EA can and WILL FAIL , therefore the standard capital protection settings will close all orders when the Drawdown exceeds the 25% of the balance. This can be customized in accordance with the risk acceptance of the investor. In case of a 20% loss the EA is designed to recover in less than 300 days unless a second loss occurs before the recovery is completed.

Do not use demo or cent account as they are meaningless for this type of trading.