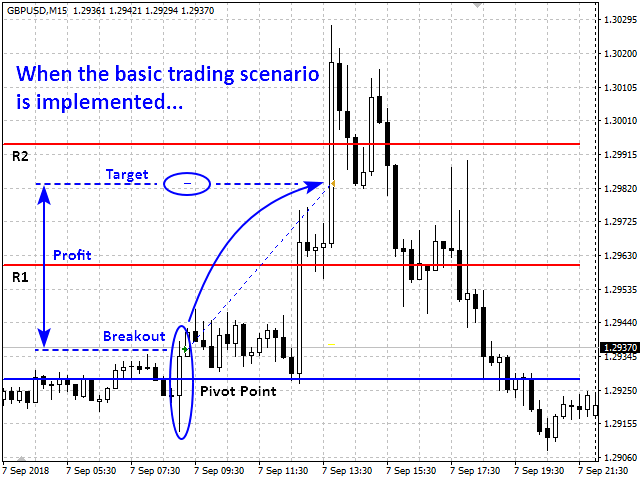

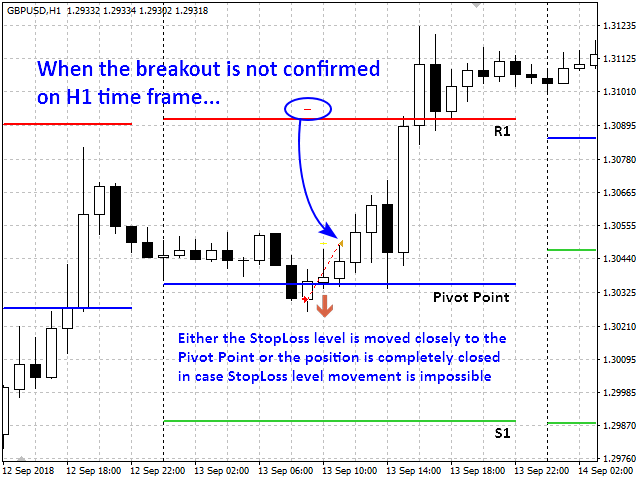

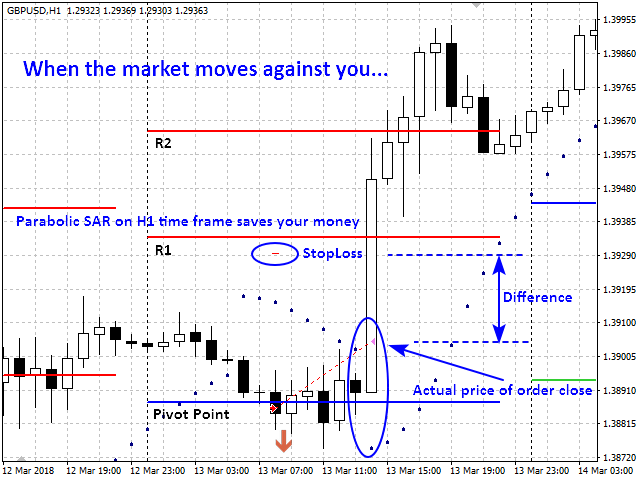

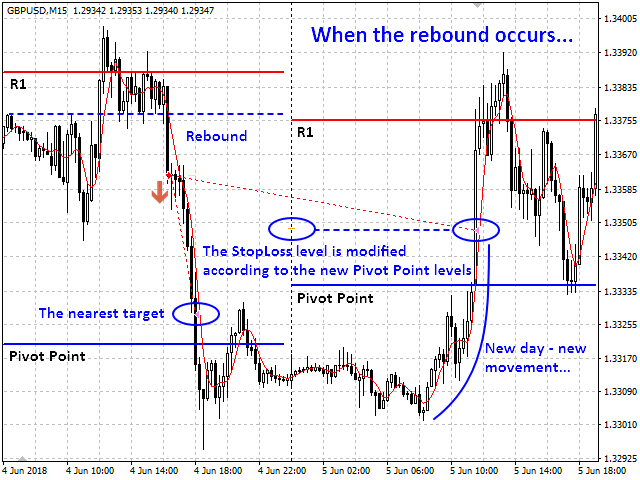

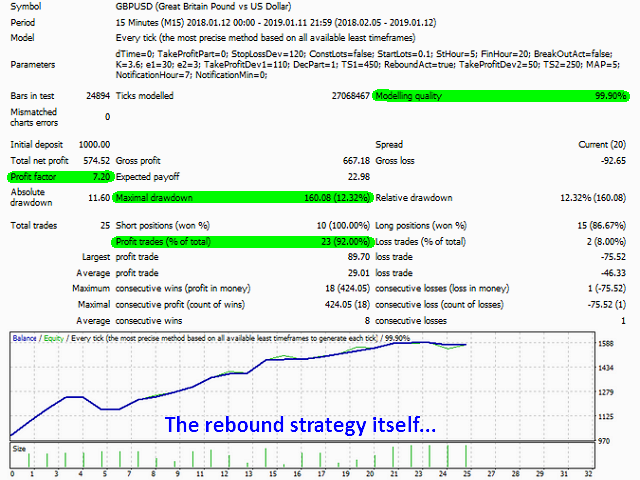

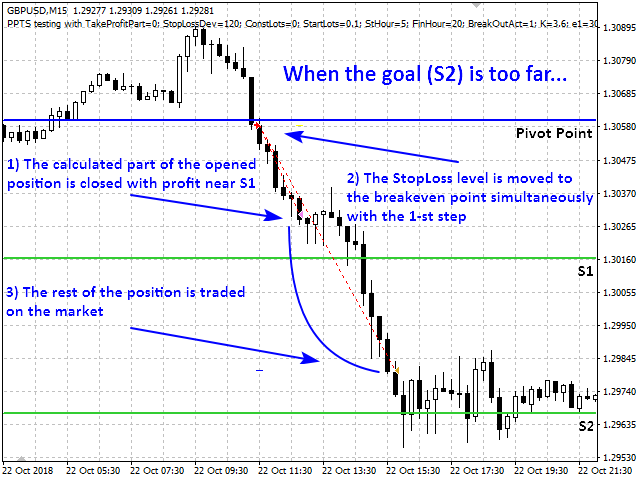

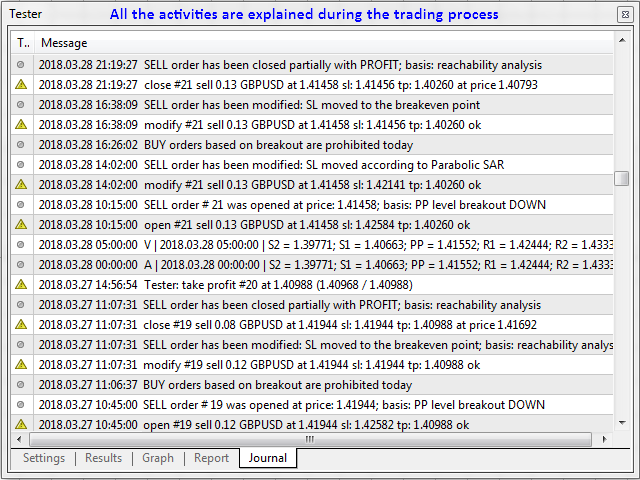

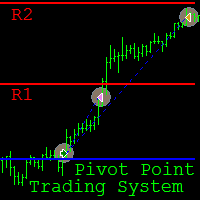

Pivot Point Trading System is a fully automated Expert Advisor (EA) designed for intraday trading on the M15 time frame . The main currency pair is GBP/USD , however it can be used on other pairs, provided that the input parameters are selected through optimization in the strategy tester. The EA implements trading strategies based on the breakout and rebound from the Pivot Point levels . The principle of the EA consists in order opening in the direction of the breakout of the Pivot Point level (with filtering the false breakouts), as well as towards the Pivot Point level in case of the price rebound from other support/resistance levels (R2, R1, S1, S2). Only one order of each type can be opened simultaneously. All orders are opened with StopLoss and TakeProfit. The StopLoss level can be changed through the trading process only in the direction of risk reduction . The order volume can be either fixed (set by the user) or variable (calculated by the EA) depending on the average account balance. The EA implements various tactics of the full and partial close of losing positions until the price reaches the StopLoss level and the full and partial close and the preservation of the profitable positions.

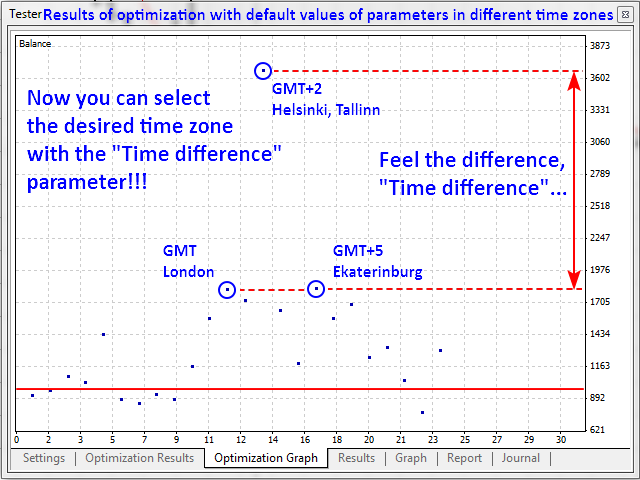

Due to the different terminal time set by different brokers from different time zones, formed bars and calculated levels also differ. Therefore, trading results can also be different. In order to avoid incorrect trades the time zone management tool has been embedded to the new version of the EA.

Logic of the tool: Your TERMINAL time zone + "Time difference" = DESIRED time zone. Example: GMT+9 + (-7) = GMT+2.

Parameter Meaning Time difference

The shift of the time (in hours) to the desired time zone

TP part

The part of the opened position volume that will be closed with profit in the area of the nearest support/resistance level

SL deviation

The deviation of the Stop Loss level (in points) from the support/resistance level

Constant lot Enable/disable the constant order volume option. TRUE - constant volume; FALSE - variable volume Specified lot

The volume of the opened order, in case of using the constant volume of an order

Time range start hour

The hour of the beginning of the time range for order opening (SPECIFIED time)

Time range last hour

The hour of the end of the time range for order opening (SPECIFIED time) Breakout strategy activation

Activation of the EA on the Pivot Point breakdown strategy implementation. TRUE - enabled; FALSE - disabled Coefficient for trading range identification The coefficient for determining the trading range

Breakout candle Open price deviation The minimum deviation of the breakout candle Open price (in points) from the Pivot Point level Breakout candle Close price deviation The minimum deviation of the breakout candle Close price (in points) from the Pivot Point level TP deviation (breakout strategy)

The deviation of the Take Profit level (in points) from the target support/resistance level

Decrease risk part

The part of the opened position volume that will be closed at the middle level when the price moves against the opened position

Trailing stop (breakout strategy)

The number of price movement points before StopLoss moves to the break-even point ( does not follow the price )

Rebound strategy activation

Activation of the EA on the rebound strategy implementation. TRUE - enabled; FALSE - disabled TP deviation (rebound strategy)

The deviation of the Take Profit level (in points) from the target support/resistance level Trailing stop (rebound strategy)

The number of price movement points before StopLoss moves to the break-even point ( does not follow the price ) Averaging period

The averaging period of the moving average that determines the rebound from the support/resistance level

Hour for message sending

The hour of sending to the mobile terminal the message with levels for the current day (TERMINAL time)

Minute of hour for message sending The minute of the hour of sending the message to the mobile terminal

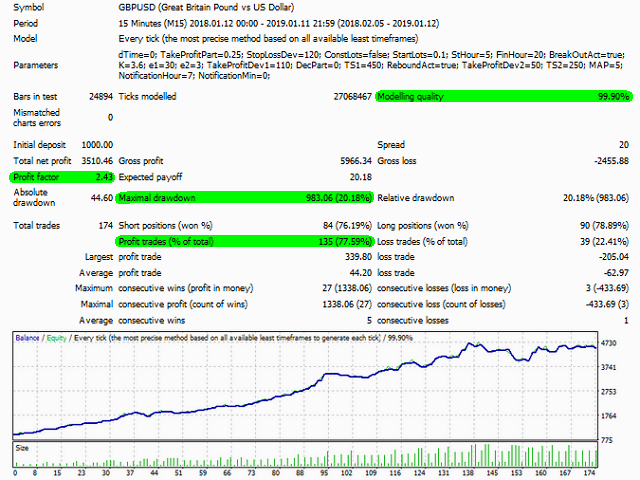

The default values of the parameters have been found for the GBP/USD currency pair as a result of optimization over a long time period . The back tests have been carried out on the quotes of 5-digit brokers with a modelling quality of 99.9% . The best results have been obtained in the GMT+2 time zone .