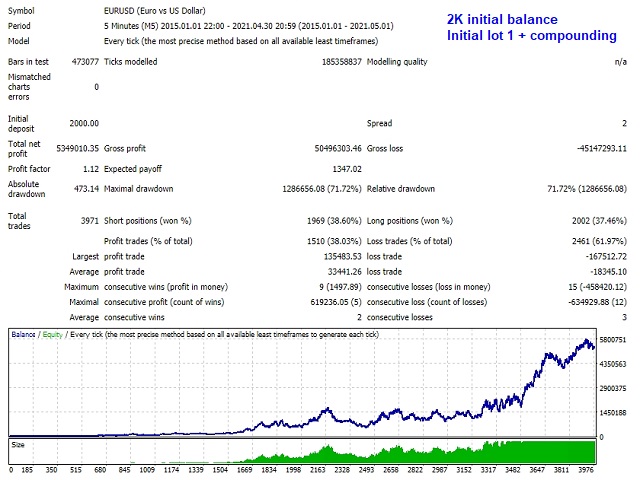

This EA Sniper Breakout is based on a meticulous breakout strategy and it identifies a "good" support / resistance level in which to place a pending order with a Stop Loss and a Take Profit in place.

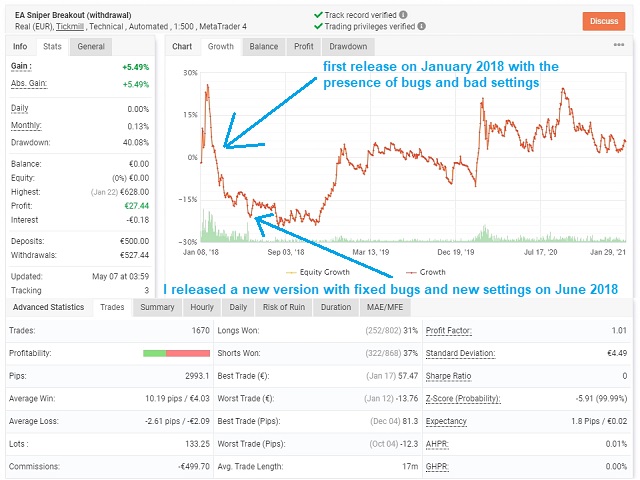

The first version was released with outstanding parameters (like 2,5 pips SL and 25 pips TP), but it wasn't applicable on real conditions, therefore I adjusted the SL and TP size and I found good parameters that are sustainable in real market conditions with fair and good performances.

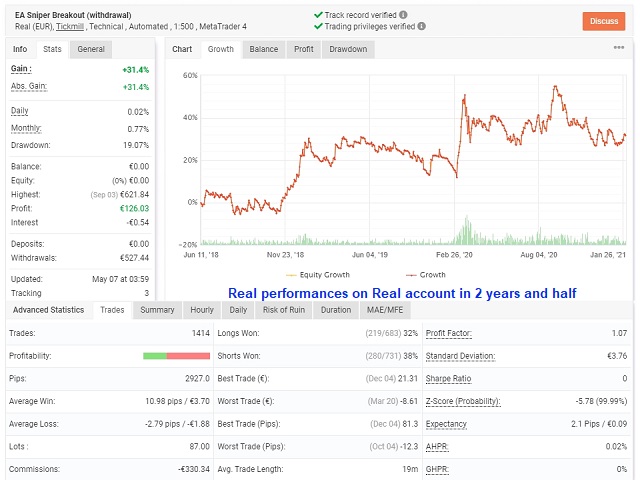

The first release of this EA was on January 2018, and I can tell you that it's a sustainable system in the long term and you can add on your trading portfolio.

In January 2021 I disabled the previous EA and I attached the new EA v2.1 in a new fresh account.The system works on EURUSD M5 .

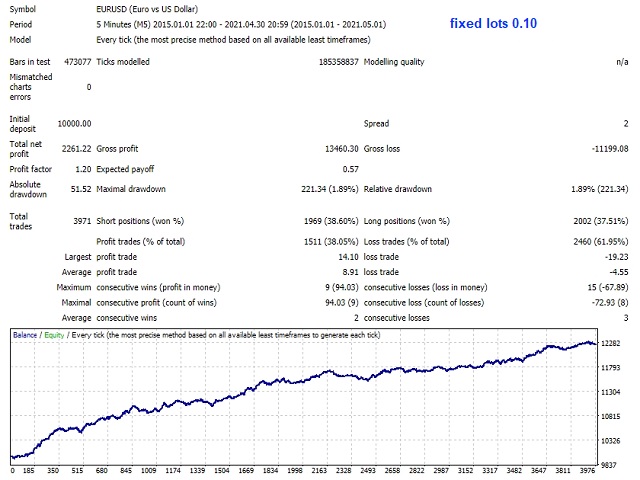

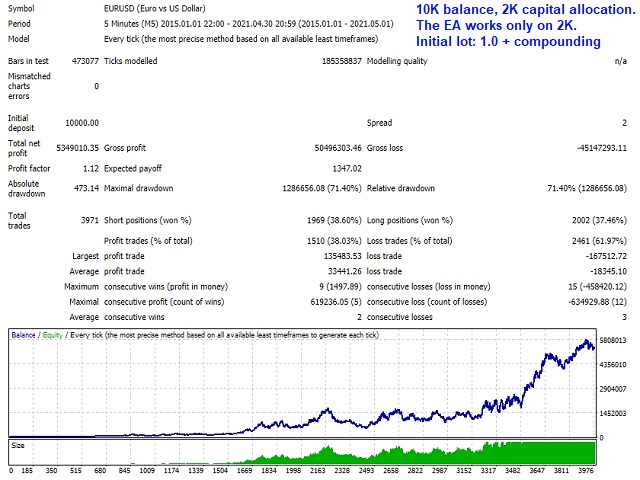

In all my EAs and Portfolios I have a new beautiful feature called " capital allocation ", this option allows to allocate a certain amount of money for this specific system and then it will calculate the Money Management and every other parameters from that capital allocation ; this is very useful because in this way you can control risk and you can't burn out all your capital! For example let's say that you have 10K in your account and you want to allocate 2K for this system, if all trades (closed and open) are reaching -2K, the system will close all the trades and the EA will be instantly disabled. This powerful feature is essential for the risk management.

Here I show and explain the main settings for this EA:

- Magic Number: it works on the magic number and identifies each position with that number.

- Date to start counting the MM: the date from where the Money Management for the "capital allocation" is calculated. The system will calculate all closed and open trades from that date (based on Magic Number) and set the MM accordingly.

- Capital to allocate: this is an important feature that every EA must have! Here if you select an amount, for example 2K, it will work only on that 2K and will no affect the other portion of your account!

- Entry lots: initial lot size for the trades.

- Compounding: compounding effect calculated from the capital allocation .

- Profits conservation: it will virtually subtract/withdraw some % of the profits and Money Management will be calculated after that virtual withdraw.

- Relative DD% protection: if the relative DD in % calculated from the capital allocation will it that threshold, the EA will close all positions.

- Trading hours: you can select the hours range where the EA will trade (the format need to be hh:mm).

- Close orders on Friday: all trades will be closed on Friday at "Friday Close hour".

- Statistics. Generate Report: you can choose a report generated in excel after the backtest is done (it saves a file on tester->Files after the backtest)

- Show Dashboard: show a dashboard with all indications about performances, capital allocation, win ratio, etc.. useful on live trading. I suggest not to use this option when you backtest because it slows down the tester.

For info don't hesitate to contact me.