The EA trades on the DERIV Broker SYNTHETIC instruments:

Boom 500 Index, Boom 1000 Index, Crash 500 Index, Crash 1000 Index . Select the instruments accordingly in the input section.

The EA waits for extreme events and profits when things normalize.

Frequency of trades is between 1 to 8 trades per week depending on opportunities identified as " High opportunity " and " Normal opportunity ". High opportunity trades are 3 times normal volume.

EA has one other input " betsize_percentage " . That determines how much of your total equity you want to invest per normal opportunity trade.

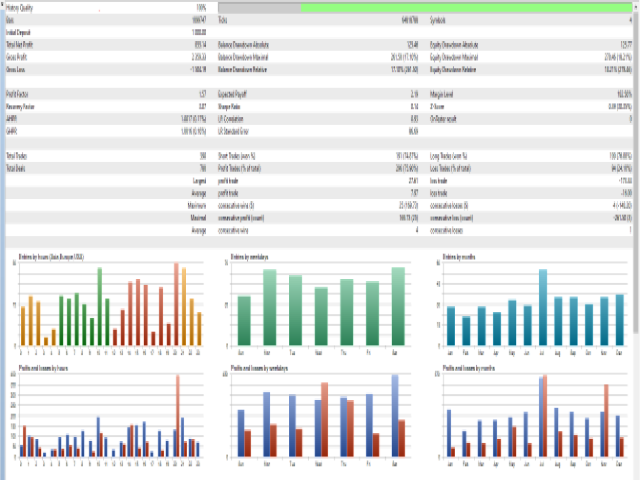

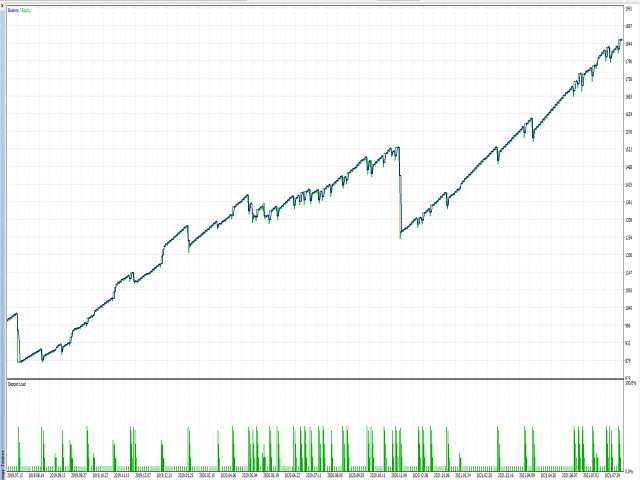

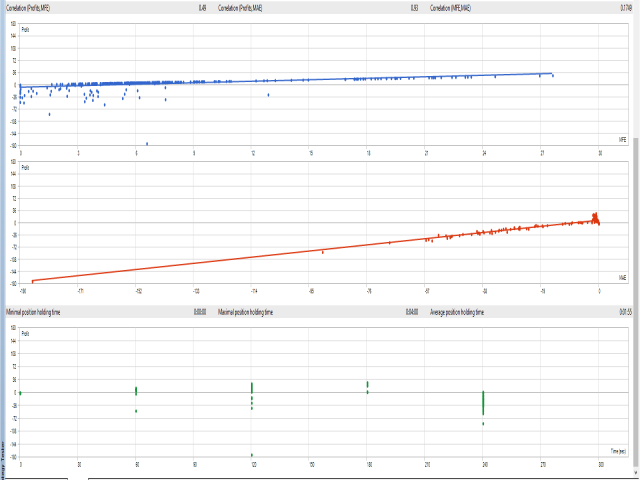

I recommend bet size of 5%. This means higher higher opportunity trades will be 15% of total Equity. The risk of bet sizes larger than 10% is that if the the EA is incorrect you might not have enough maintenance margin for the EA to make up the loss. However bigger bet sizes mean bigger rewards - The graphs shown are a strategy tester based on a bet size of 5% and a 1000 USD starting Equity.

Weigh your risks and rewards carefully. Happy algo-trading