3-SMA-Spread - cross-instrument Indicator of market Spread of 3 (three) different instruments via building visual iChannel (see below formula) that is changing its Width proportionally to the input from each instrument ("Statistical Arbitrage" based on SMA ).

Core principle: Price lines following the prices of "their" symbols after each discrepancy are constantly tending to return to the total of "synthetic" central. In other words, a system of 3 "related" instruments//pairs constantly strives to revert to their mean (so called " mean-reversion " effect).

- Works on any Instrument/TF (must open Charts/TF for all instruments used)

- Synchronization in place. After current bar is closed -- No re-paint / No re-draw

- " SetIndexBuffe r" available for all variables (can be used in EA)

- Auto-detect 4- and 5-digit prices

The following formulas have been used to build iChannel :

- Price-line Symbol-1 - chart where Indicator is turned on

- Price-line Symbol-2 - plus " reversal=true " Mode for instruments with negative correlation

- Price-line Symbol-3 - рlus " reversal=true " Mode for instruments with negative correlation

- Middle-line М = "synthetic" central (S1 + S2 + S3)/3 (yellow dotted line)

- iChannel = (S1-M) + (S2-M) + (S3-M) (red and green dots)

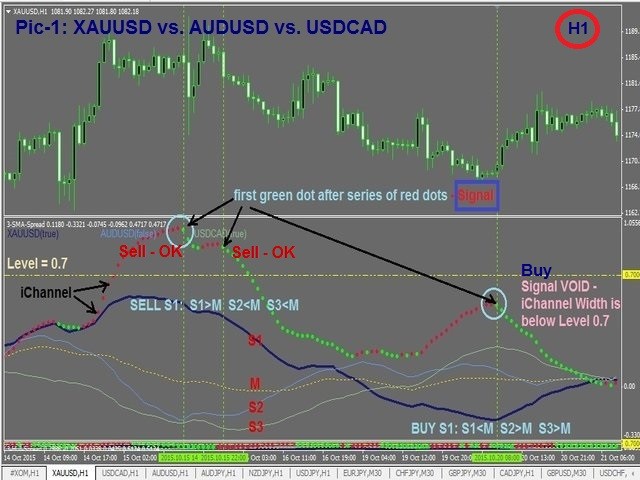

This formula allows combining various instruments on one chart (see Fig. 1), for example:

- XAUUSD ~1100

- AUDUSD ~0.7

- USDCAD ~1.33

Conditions for Signal :

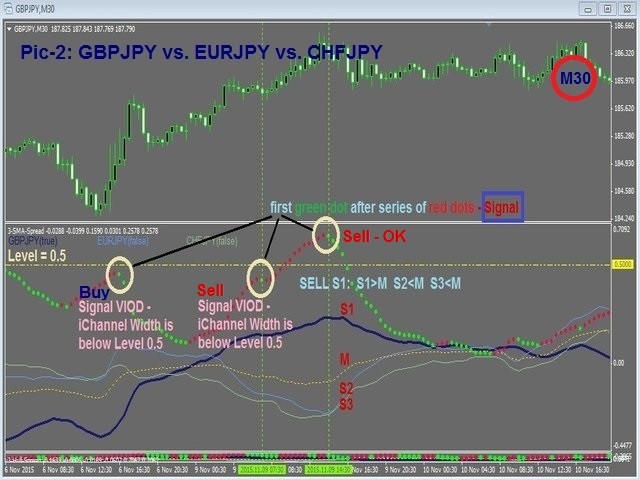

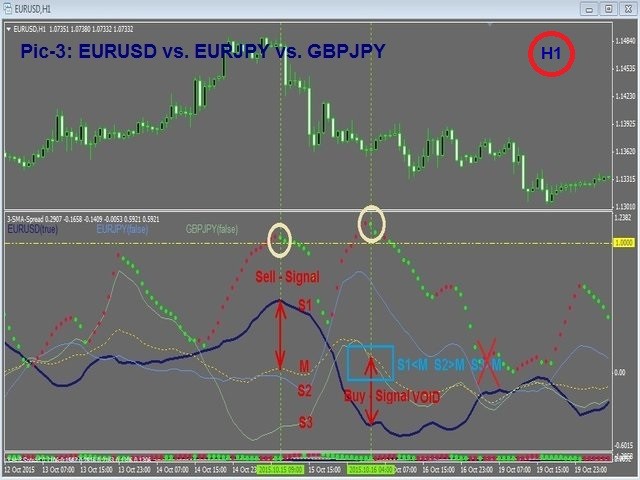

#1. Width of iChannel started to narrow (first green dot after series of red dots)

#2. Width of iChannel > Level

#3. Price Line S1 is on one side of Middle-line М , аnd Price Lines S2 and S3 are on the opposite side of Middle-line М -- as following:

- Signal BUY Symbol-1 : S1<M S2>M S3>M -- NOTE: iChannel width (red and green dots) is changing wider or narrower

- Signal SELL Symbol-1 : S1>M S2<M S3<M -- NOTE: iChannel width (red and green dots) is changing wider or narrower

Parameters:

- Inp_Fast_MA - period of Fast moving average

- Inp_Slow_MA - period of Slow moving average

- Inp_MA_Method - parameter of SMA

- Inp_MA_PriceType - parameter of SMA

- Inp_Symbol_1 - Symbol-1 (by default GBPJPY )

- Inp_Symbol_2 - Symbol-2 (by default EURJPY )

- Inp_S2_revers - =True in case Symbol-2 has negative correlation to Symbol-1

- Inp_Symbol_3 - Symbol-3 (by default CHFJPY )

- Inp_S3_revers - = True in case Symbol-3 has negative correlation to Symbol-1

Other useful information:

Typical EXAMPLES of highly correlated 3-way instruments:

- GOLD vs. gold-forming currency pairs AUDUSD, USDCAD and NZDUSD

- GOLD vs. Crude/WTI and Brent/BRN

- Stocks vs. Indices (S&P500, NASDAQ, DJIA etc.)

- Soybean Meal March 2016 (ZMH16) vs Soybean Oil March 2016 (ZLH16) vs Soybeans March 2016 (ZSH16), etc.

Complete list of 120 classic 3-way combinations of currency pairs - see link in the Comments section.

NOTE: for classic 3-way combinations (where participating 3 currencies only), Middle-line М will be always a straight line.