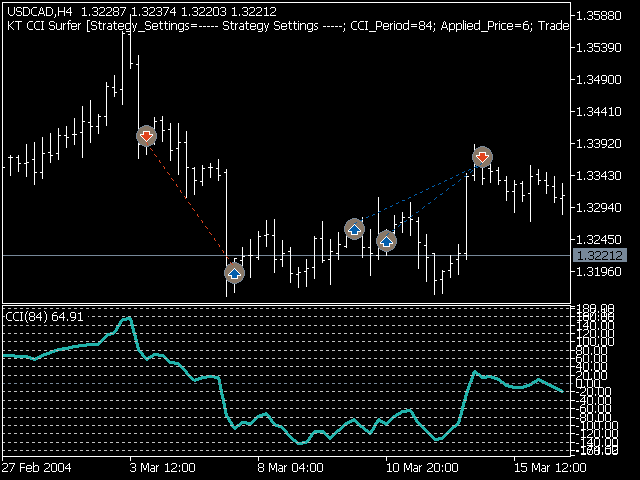

KT CCI Surfer uses a mean reversion trading strategy with a combination of extreme overbought/oversold zone detection using the Commodity Channel Index (CCI). Developed by Donald Lambert in 1980, CCI is a leading indicator that helps to identify the overbought/oversold region in the market without any lag.

KT CCI Surfer uses a mean reversion trading strategy with a combination of extreme overbought/oversold zone detection using the Commodity Channel Index (CCI). Developed by Donald Lambert in 1980, CCI is a leading indicator that helps to identify the overbought/oversold region in the market without any lag.

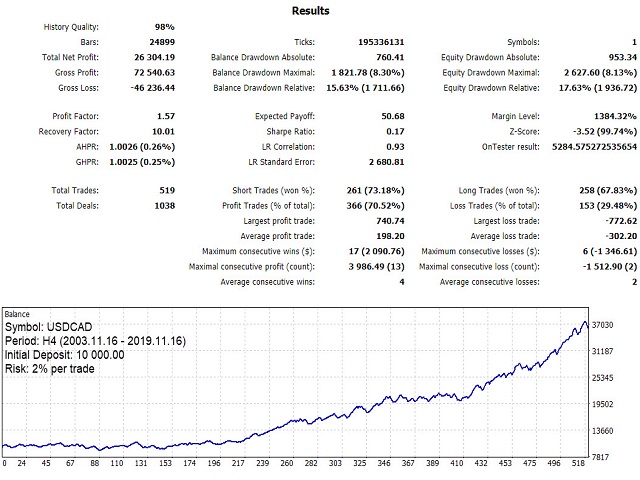

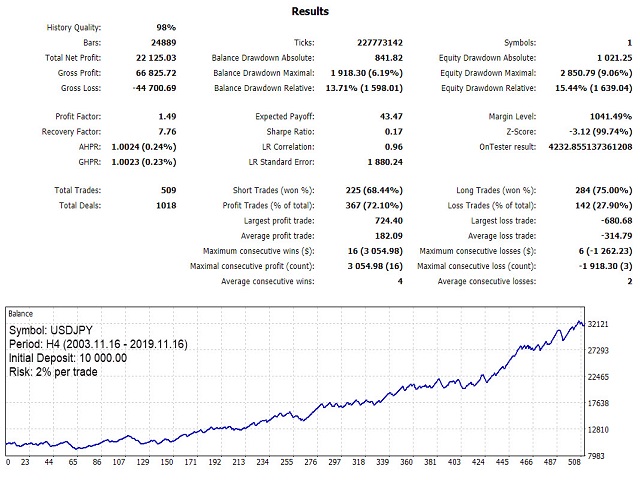

Obviously, not every overbought/oversold signal turns out into a price reversal. However, when combined with a well-planned mean reversion strategy, it produces excellent results.

Recommendations

- Pairs: All major pairs.

- Timeframe: 4-Hour

- Account type: Hedged

- Leverage: 1:100

- Risk: 2% per trade

Features

- KT CCI Surfer incorporated a genuinely advanced mean reversion strategy combined with the lag-free detection of overbought/oversold zones using CCI.

- Volatility based stop loss and profit target to achieve more stable and proportional growth.

- It is equipped with multiple entry filters such as trend filter, vortex filter, volatility filter, MMI, and week days filter.

- Fixed fractional money management to achieve an exponential equity growth.

Input Parameters

- ----- Strategy Settings -----

- CCI Period: choose a CCI period between 14 to 100.

- Apply to: Typical price (we don't recommend to change this value.)

- ----- Trade Settings -----

- Lot Size Method: fixed lot size / auto lot sizing

- Risk per trade: we recommend 2% risk per trade.

- ----- Exit Settings -----

- Stoploss Method: none / pips / volatility

- Takeprofit Method: none / pips / volatility

- SL Trailing Method: none / pips / volatility

- ----- Set the filters -----

- Trend Filter: if true, it open positions only in the direction of trend.

- Volatility Filter: if true, it allows positions only in a duration of high volatility.

- Vortex Filter: if true, it filters the entries using the Vortex filter.

- MMI Filter: if true, it filters the positions using the Market Meanness Index.

- Day Filter: allows or debar the trades on certain days of the week.