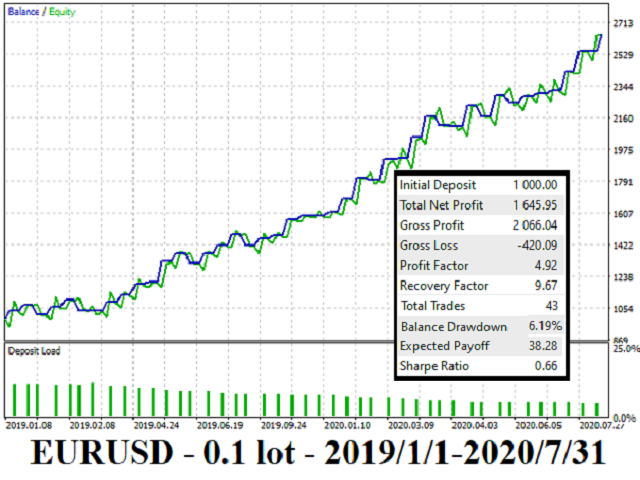

- Use on EURUSD

- Use on M5

- Intraday trading.

- Analise the price movements on the H1 timeframe (TF) (This allows to trade even in the absence of a global price trend).

- Analyzes 2 or 3 timeframes.

- On each TF, the EA analyzes the relative position of the price and moving averages (MA) (one or two on each TF).

- The operation algorithm is shown in the screenshot

- Sets is in Comments

Advantages

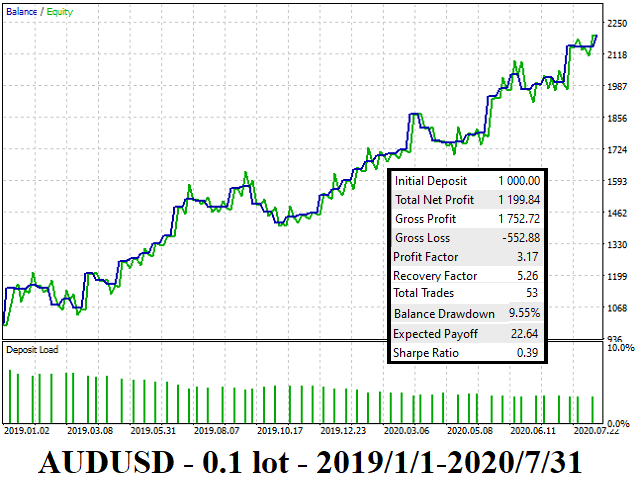

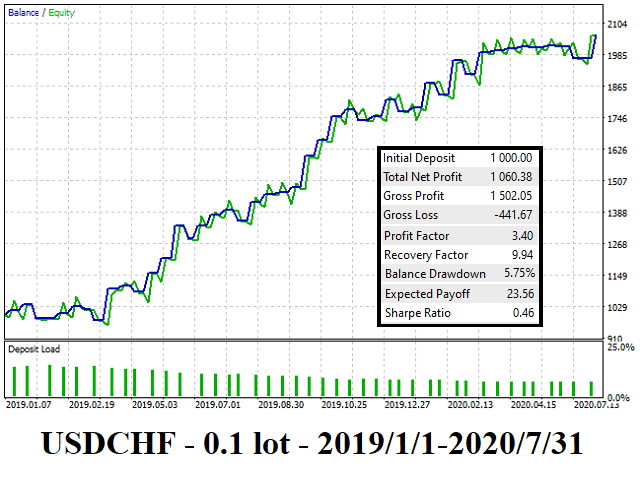

- The EA can be easily optimized for any instrument at any moment.

- Flexible customization specifically to your needs by optimization.

- Does not use high-risk money management strategies, such as Martingale, etc.

- Minimum deposit is 200 USD at risk of 1 cent per 1 point

- Full support from the developers

Version MT4: https://www.mql5.com/en/market/product/21123/

Version MT5: https://www.mql5.com/en/market/product/20986/

Parameters

- GENERAL PARAMETERS

- close_orders_on_weekend – closes the trade on Friday close_orders_on_weekend_minute minutes before 0:00

- MM_invisible – true – virtual MM. Old levels are not stored when restarting the EA

- SLIPPAGE – Slippage

- Size_of_lot – Fix_lot trades are opened with a fixed lot specified in the lots__ parameter. Smart_lot_by_risk volume is calculated dynamically, max_risk – maximum risk. When the capital decreases, the volume is not decreased

- magic_number – magic number

- MONEY MANAGMENT PARAMETERS

- trailing – type of StopLoss (see full description)

- Classic_SL – " SL_ " parameter

- Trailing_SL - " SL_ " and " TRSL_ " parameters

- Breakeven_SL - " SL_ " and " TRSL_1 " parameters

- Trailing_SL_by_jumps - " SL_ ", "TRSL_1", " TRSL_2 ", " TRSL_3 " parameters

- TP_ – TakeProfit

- MAIN PARAMETERS

- MA_tf – TF, it is recommended to set the TF in ascending order

- MA_ma_period – МА period

- MA_ang – minimum inclination angle of MA

- MA_percent – maximum % of distance between the price and MA

- MA_opp_deal_open – if true, when the price moves away from the first MA more than MA_1_opp_deal_percent percents, a signal will be generated in the direction of return towards the first MA

- MA_opp_deal_percent – minimum % of distance between the price and MA to generate a signal to return to the first MA

- MA_second_ma_use – if true, enables the second MA on this TF, its operation algorithm is identical to that of the first one. The parameters are identical and have the prefix "second_ma"

- The same parameters are available for the remaining 2 TF.

- SYSTEM PARAMETERS

- quant_bars_for_scale – the number of candles in history to scan the market

- num_bar_angle_last – the number of bars between which the angle is measured.

- all_ma_method – MA calculation method

- all_ma_price – price type to calculate the МА

- CUSTOM_MAX_trades_per_month – the minimum number of trades the robot must perform in a month during optimization

Optimization method

It is recommended to perform optimization once every 2-3 months, on the interval from 16 to 24 months.

Use the parameters from the MAIN PARAMETERS and MONEY MANAGMENT PARAMETERS groups for optimization, selecting 2 or 3 TF.