Multi Strategist (MS) is a strategy scanner and fully automated multi-currency Expert Advisor. This Expert advisor offers a streamlined framework for strategy scanning. On top of that MS is capable to utilize those strategies for live trading in a trading friendly environment by:

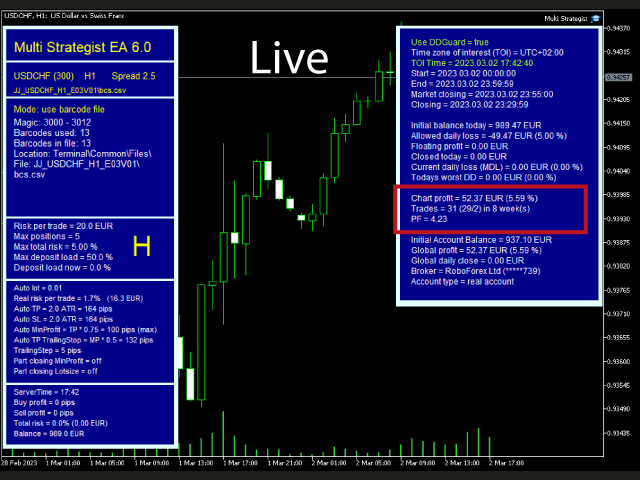

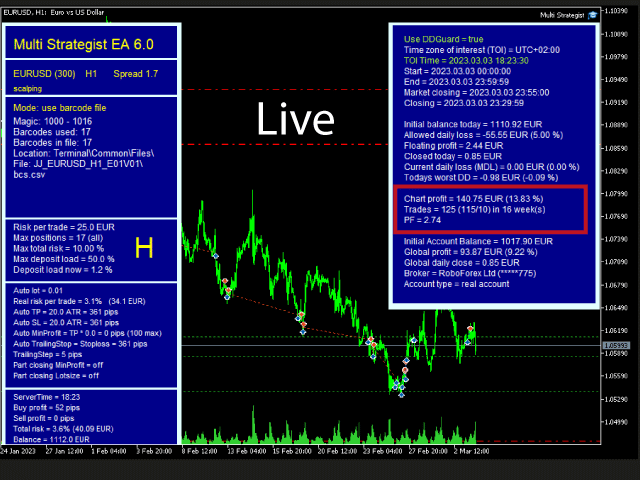

- providing multiple layers of strict risk/drawdown management

- info panels providing detailed info about chart and terminal profits/losses

- tutorial/info material

Each strategy utilizes a combination of multiple indicators, candle patterns, and or price action approaches. This analysis is done simultaneously on up to four timeframes.

The strategies are developed using a built-in strategy scanner containing over five hundred unique trading approaches including e.g.:

- technical indicators

- price action

- pattern recognition

The new version (MS6) is completely re-programmed and features have expanded significantly since the previous version (2021). Striking improvements have been achieved in:

- Strategy scanning time by

- The ability to scan for (and save) a (technically limitless) number of strategies at the same time.

- Improving the overall program running speed.

- Compatibility with indices next to Forex pairs.

- Highly improved drawdown guard aiming in protecting against successive losses during wrongly predicted market movements.

The technical analysis implemented in the strategies utilizes are among others:

- Moving Averages

- Pivot Points

- Retracements

- Stochastic Oscillator

- Directional Movement Index (DMI) & Average Directional Index (ADX)

- Alligator

- Momentum

- Relative Strength Index (RSI)

- Moving Average Convergence/Divergence (MACD)

- Williams Percent Range (WPR)

- Candle patterns

- Price action trading

- Trend analysis

- Convergence/Divergence

Highlights

- For beginners and advanced users

- The strategy scanner harbors around 500 unique and combinable trading approaches

- The market changes over time, so change with it!

- A definable number of strategies trading in parallel per instrument

- Simultaneous analysis of multiple timeframes

- The new strategy scanner in MS6 allows strategy development in a short amount of time (cloud compatibility)

- Each strategy may have its own exit strategy

- The strategy scanner may be applied to Forex and CFDs (Indices)

- Multiple layers of strict risk and money management

- Volatility sensitive stop losses and take profits

- Trailing stops and trailing take profit support profit taking and loss limitation

- Partial Closing of positions

- Weekday filter/Optional automatic trade closing on Fridays

- Several info panels

- Possibility to choose between market and pending orders

- FTMO compatible daily drawdown management helping to prevent consecutive losses during unpredicted market movements

Recommended settings

- Account balance: >1000 USD ( or equivalent amount in your currency).

A lower balance is possible, but the risk per trade might exceed the setting. In this case it is recommended to use a cent-account (micro account).- A leverage of over 1:100 is desirable but always dependent on balance and strategy files used.

- Risk-managment for strategy scanning or adapting available strategy settings:

- < 2.5 % risk per trade.

- activated DD-Guard set to 5%.

- The DD-Guard is on top of the hierarchy. If it is activated it will overrule the max total risk setting. (Check manual for details).