Strategy Summary

The Alpha Beta system is partly based on my Cycles Indicator but the difference is that the Alpha Beta also checks the fundamental strength of the base currency and the profit currency; for EURUSD the base will be EUR and profit currency will be USD. Thus, the name Alpha Beta, Alpha is always the base and Beta is always the profit currency.

The system of measurement checks historical price moves of the EURUSD on multiple timeframes and uses the pattern it discovers to determine whether the EURUSD is strong or weak; it gives EUR a value (Alpha value) and USD a value (Beta value), if the alpha value is more than X (the value specified as Alpha) greater than the USD's value (its fundamental score). The EA then uses four indicators also on multiple timeframes to enter a trade in direction of the very latest trend.

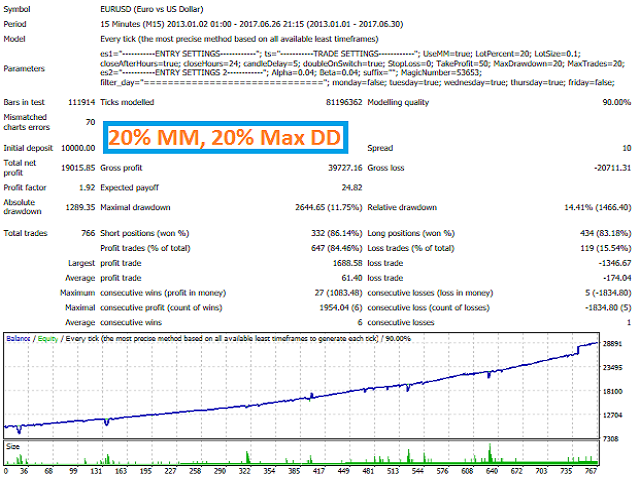

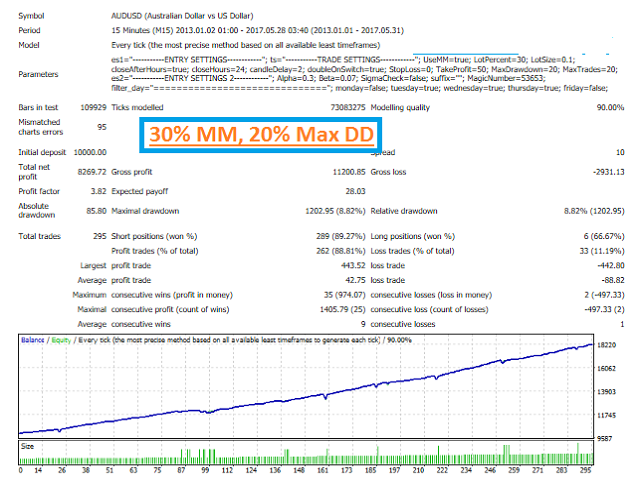

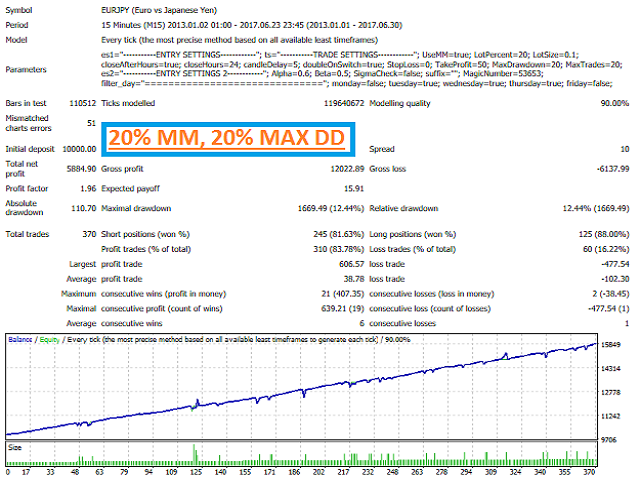

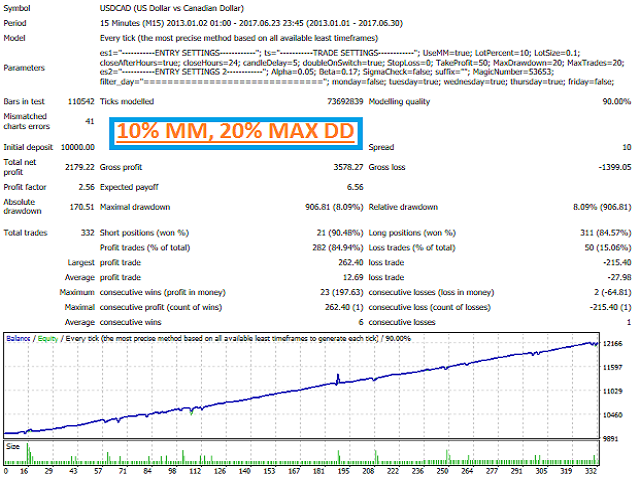

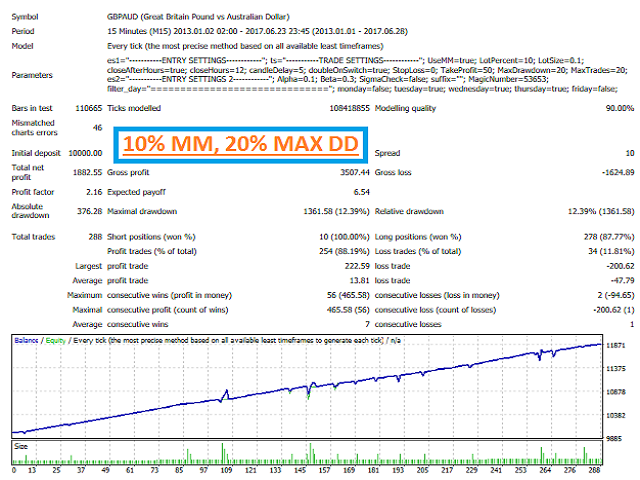

The system moves to close small profits consistently and when it closes loss, it uses a very safe averaging method to recover losses fast. If this also fails, there is a Max Draw down parameter that will close all trades when Max Draw Down is reached.

For Optimization, only the Alpha and Beta require changing with a range from 0.01 to 10.00, I have also provided set files in the Comments section. It is also recommended that you use this EA on a low spread account, not more than 1.5 pips average spread. The lower the spread, the safer it will be.

For backtest and optimization, please make sure you have history downloaded for the following pairs; EURUSD, GBPUSD, AUDUSD, USDJPY, EURJPY, EURAUD, EURGBP, USDCAD, EURCAD, GBPCAD, CADJPY, GBPAUD, GBPJPY, AUDJPY and AUDCAD.

If you do not have history for all, your results will be inaccurate.

Parameters

- Alpha Time Frame 1: F irst timeframe used for fundamental and technical analysis on base currency

- Alpha Time Frame 2: Second timeframe used for fundamental and technical analysis on base currency

- Beta Time Frame 1: First timeframe used for fundamental and technical analysis on profit currency

- Beta Time Frame 2: Second timeframe used for fundamental and technical analysis on profit currency

- Use Money Management: Use Money Management

- Money Management %: Percentage risk for Money Management

- Manual Lot Size: Choose Manual lot size when Money Management is false

- Close After Hours: You can turn off hours close for the first trade

- Hours To Close: First trade is usually closed after 24 hours by default, you can set this to any value you want

- Delay Between Trades: Number of candles to wait after opening one trade

- Raise Lots for Recovery: This is where you turn off lot increment during averaging

- Delay Increase: I ncrement during averaging can be delayed here, it will only increment when it switches from buy to sell or sell to buy

- Stop Loss (Points): Stop loss is not recommended but you can use it if you want

- Take Profit (Points): Here you set your TakeProfit value, TakeProfit is hidden by default and it is in points

- Maximum Drawdown % (Set 0 to Disable): This is where you set the max drawdown you want to allow, when trades are losing and this % of drawdown is reached, all trades will close

- Maximum Number of Trades: Here you set the Max Trades you want open at a time

- Alpha: Strictly for optimization, this will allow you to try multiple strength values for the base currency

- Beta: Strictly for optimization, this will allow you to try multiple strength values for the profit currency

- Chart Symbol Suffix: If your pair has a suffix like "EURUSDmini", enter the suffix in this parameter (simply enter mini in the parameter)