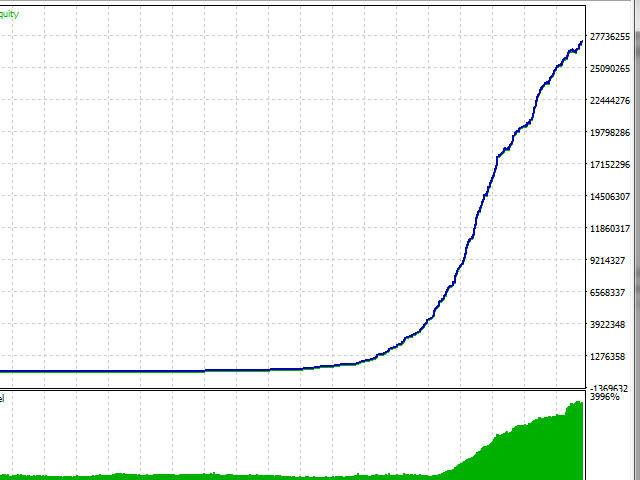

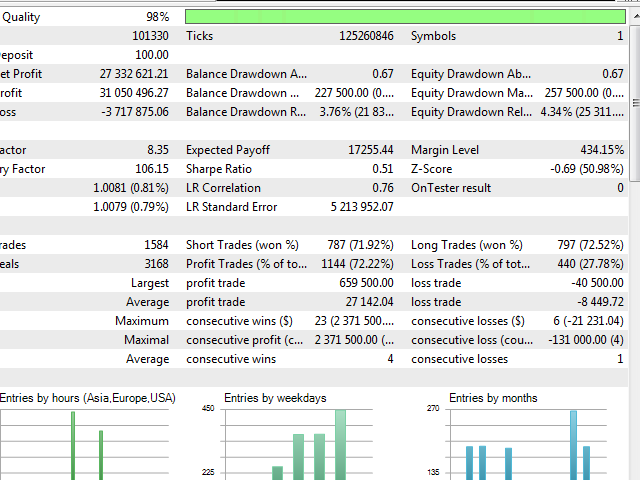

The advisor performs candlestick analysis of the chart, measures the strength and speed of the price. Usually, after a strong and sharp price deviation, it tends to return to its average value, but it is not clear at what point it will reverse, in this case it makes sense to trade using averaging positions. Thus, the further the price deviates, the more positions the adviser will open, and the greater the profit can be on a price rollback.

This rule works on most currency pairs, so the robot performs quite well on many pairs with a small spread. It should be noted that if you limit the robot to opening only 1 position, using a stop loss, then in a strategy tester this method may be more effective, but in real conditions, due to spread widening and slippages at times of price activity, the result may differ radically between different brokers and on different types of accounts.

I will publish a detailed description of the settings later.