Experience the real performance of famous indicators with the Indicator Tester and Optimiser EA. This EA equips you with the tools to meticulously test, optimize, and refine your trading strategies, all while seamlessly integrating the power of hedging into your trading approach.

!!! I don't recommend using this EA on a live account, the performance hasn't been tested yet. The purpose of this EA is for you to test your ideas and show the performance of the basic indicators and the power of hedging. !!!

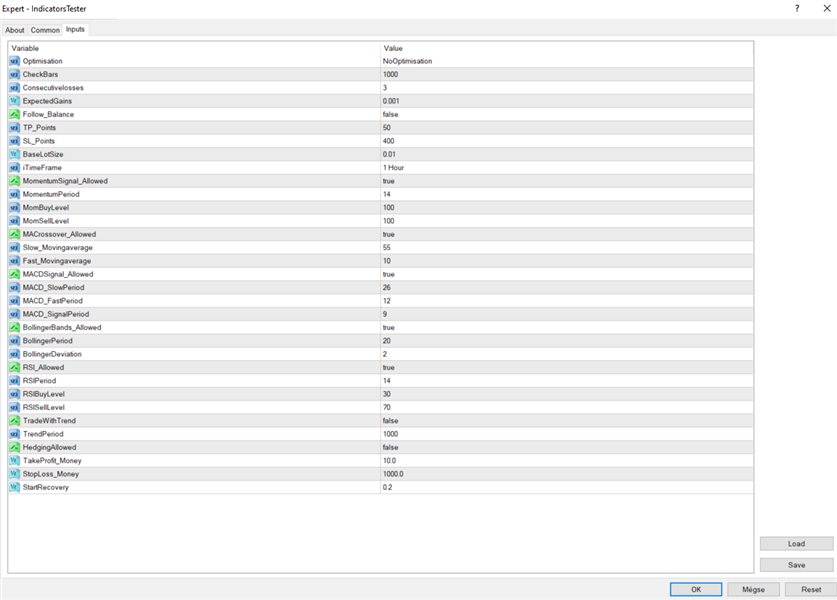

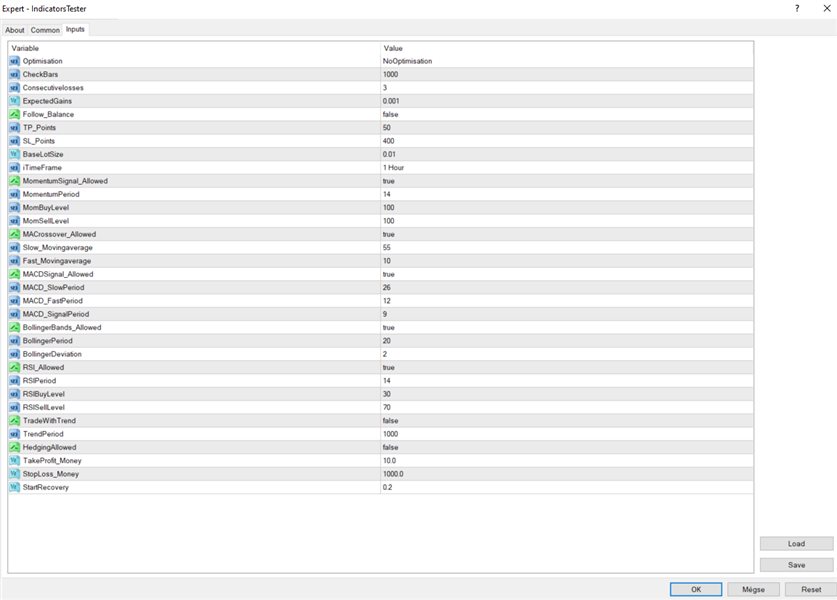

Inputs:

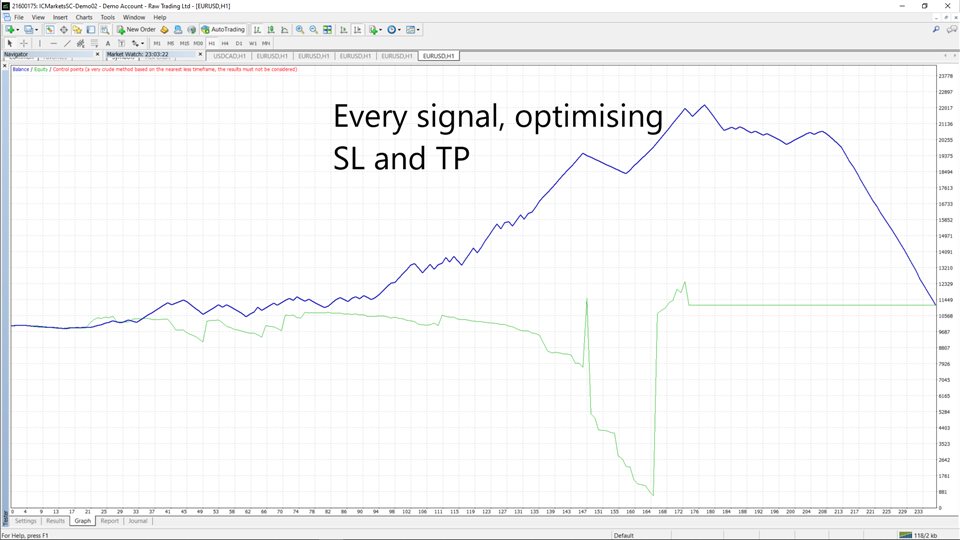

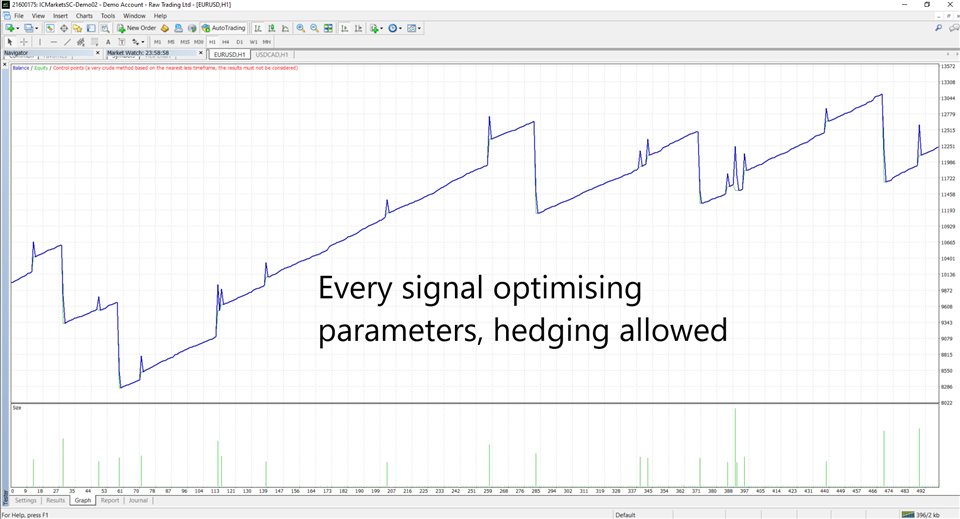

- Tailor your approach with three dynamic modes - "No Optimization" for simplicity, "TP/SL Optimization" to maximize risk-reward, or "Parameter Optimization" for precision fine-tuning.

- CheckBars: Set your analysis scope by specifying the number of recent bars for evaluation.

- Consecutive Losses: Implement comprehensive risk management by specifying the maximum acceptable consecutive losses within your defined analysis period.

- Expected Gains: Define your target expected gains, aligning your strategy with your profit objectives.

If the Signal doesn't have any optimal parameters/ R:R ratio that meets the criteria for the last selected amount of bars, the signal will be temporarily disabled.Signal Types:

- Follow the Balance: Activate this feature to dynamically adjust your lot sizes based on real-time changes in your trading balance.

- TP in points : This will be the Take Profit of the signals.

- SL in points : This will be the Stop Loss of the signals .(the SL and TP will change when the optimisation is sl and tp optimisation)

- Baselotsize: This will be the starting lot size if hedging is not allowed.

- Timeframe: Current timeframe.

Momentum Signal: Take action when momentum builds. Buy and sell signals trigger when the momentum reaches 100.

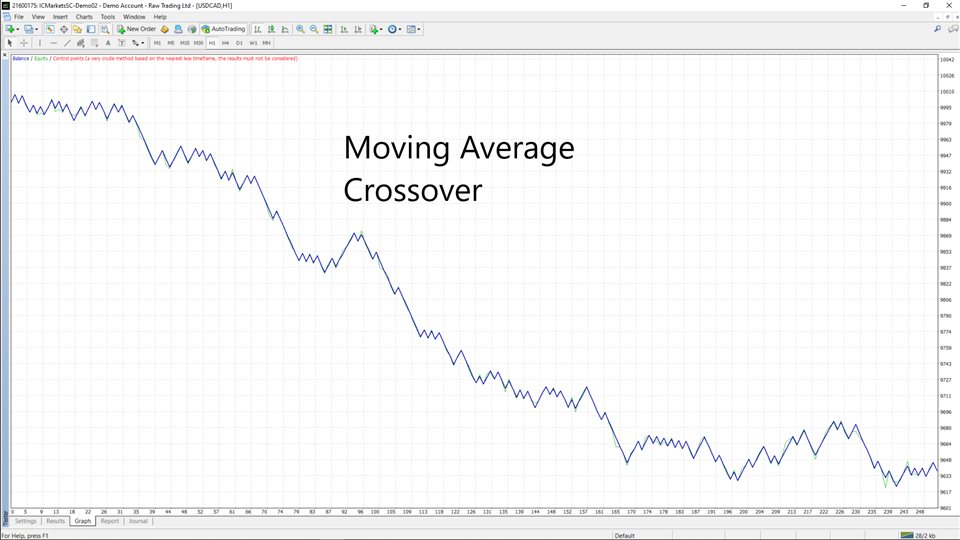

MA Crossover: Capitalize on moving average crossovers. Buy when the fast MA crosses above the slow MA and sell when it crosses below.

MACD Signal: Stay ahead with MACD. Buy on main line crossing above the signal line (both above zero) and sell on the opposite condition.

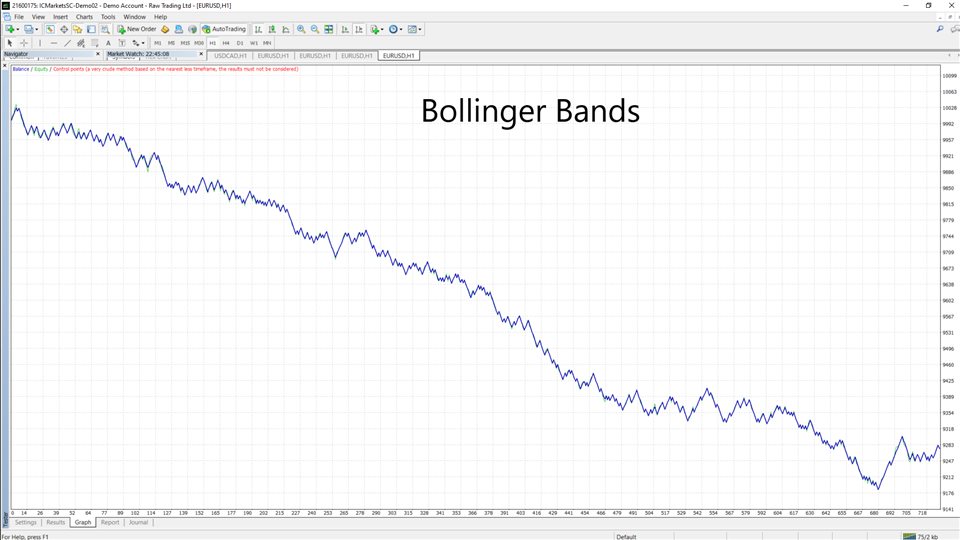

Bollinger Bands: Ride the bands for profits. Buy when prices dip below the lower band and sell when they rise above the upper band.

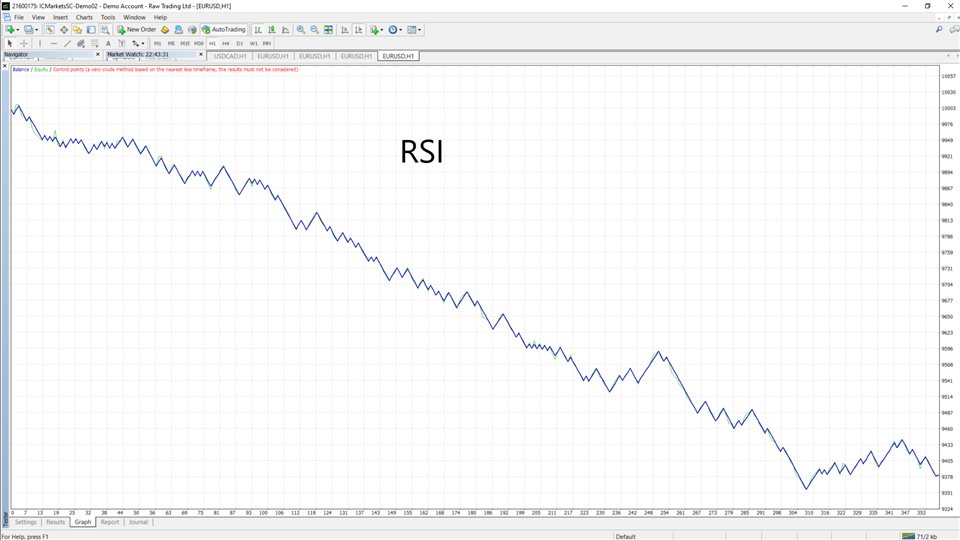

RSI: Harness the power of Relative Strength Index (RSI). Buy when RSI reaches your specified buy level and sell when it hits the sell level.

Trend: The price has to be under the Moving average with trendperiod and the price had to go down in the last trendperiod bars -> downtrend. other way around uptrend. if the two criterias do not agree there is no trend(trend is sideways).

Hedging:

Trade Objective: In hedging mode, each trade is meticulously crafted with a singular aim - achieving the TakeProfit_Money when the trade reaches its take-profit level.

Dynamic Balance Monitoring: Activate the "Follow_Balance" feature, and watch as the EA intelligently adjusts the Take Profit and Stop Loss parameters based on real-time changes in your trading balance after the closure of one or more trades.

Loss Management: The EA maintains rigorous loss control. When the predefined StopLoss_Money level is attained, the EA promptly realizes the loss, preserving your capital.

Strategic Recovery: But that's not all - the EA is equipped with a strategic recovery mechanism. It kicks into action when the unrealized loss exceeds a specific threshold, calculated as the product of "StartRecovery" and "StopLoss_Money." For example, if the StopLoss_Money is set at 500, and "StartRecovery" is configured at 0.1, the EA will initiate recovery trades only after an unrealized loss surpasses 50 USD. Subsequent recovery thresholds are established at increments of 100 USD.

If you have any questions/recommendations or you've found an error (it's completely possible) feel free to contact me. The MT5 version is not yet finished, becouse the optimisation of signals is way more complicated and resource consuming.

Hope I could be of help with this program.

I f you want to create your own Grid and Zone Recovery strategies for free, check out the AdvantEdge EA.