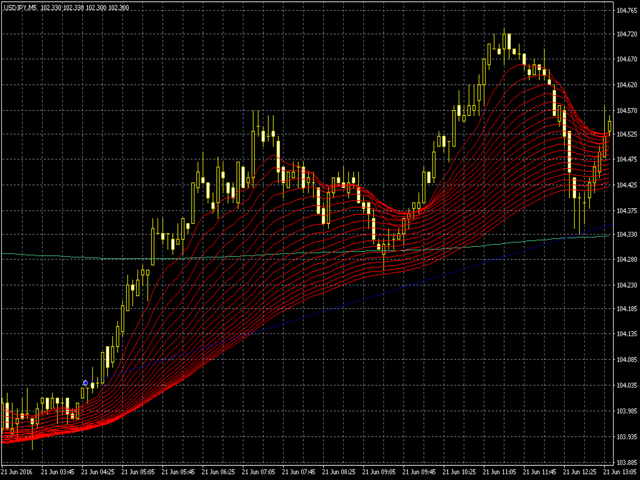

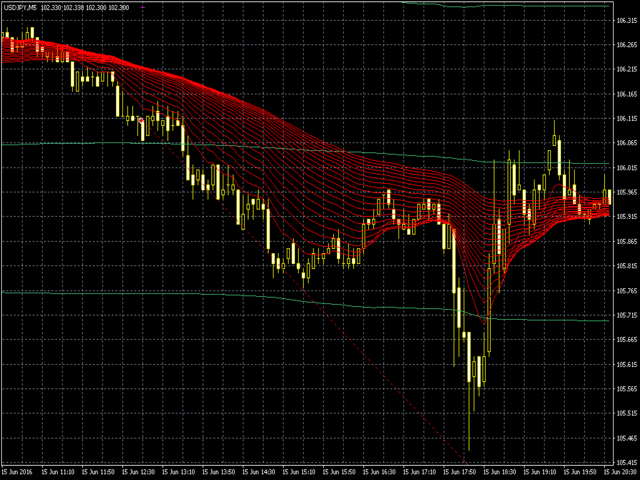

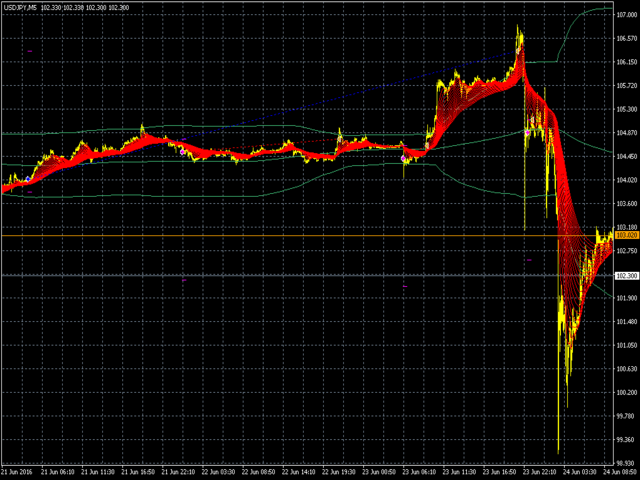

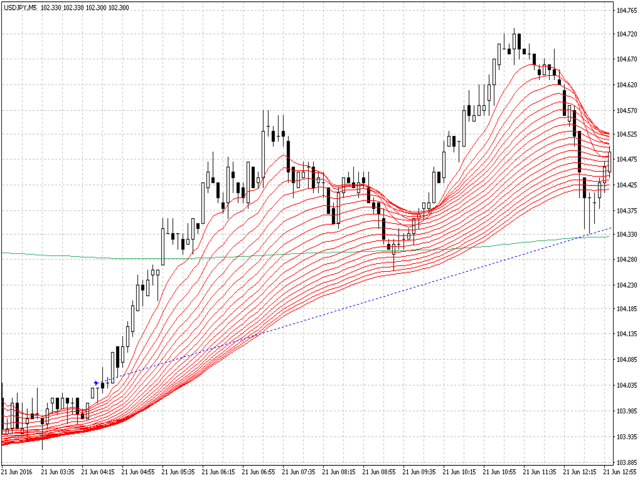

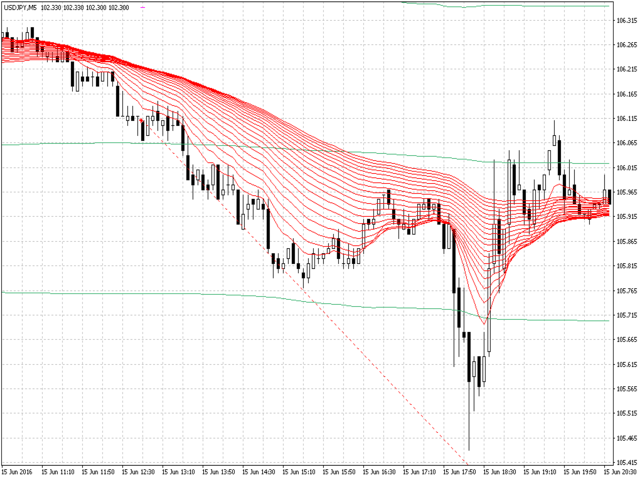

MArket Wave EA is an Expert Adviser which is trend based and trades using multiple moving averages and Bollinger Band .

Signals are generated when there is intersection between multiple moving averages and Bollinger Bands.

Input Parameters

- Distance from the Highest Sell Allowed - If a sell signal comes, price must be above the highest open sell order, plus this distance in points (even higher)

- Distance from the Lowest Buy Allowed – If a buy signal comes, price must be below the lowest open buy order, minus this distance in points (even lower)

- Total Open Sells Allowed – Maximum number of open Sell Orders

- Total Open Buys Allowed – Maximum number of open Buy Orders

- Close on opposite signal ? – Enable to close all buy orders on a sell signal, and close all sell orders on a buy signal

- SL / TP Method :

- Static - Set SL to the level in “Stop Loss In Points” and TP to “Take Profit In Points”

- ATR – Set SL to the amount of ATR multiplied by “ATR/Moving Average Multiple, for SL” and TP to the amount of ATR multiplied by “ATR/Moving Average Multiple, for TP”

- Moving Averages – Set SL to the Distance of the smallest to the biggest MA, multiplied by “ATR/Moving Average Multiple, for SL”, and TP multiplied by “ATR/Moving Average Multiple,for TP”

- Bollinger Bands – Set SL to the upper BB for sells and the lower BB for buys, and TP to the lower BB for sells and the upper BB for buys

- ATR Period, for ATR Stops – Period for ATR if ATR for SL/TP is active

- Place System Stops ?(SL/TP) – if off, SL and TP are stealth

- Lot Calculation Method :

- Lot Value - Static Lot

- % of Equity – A % of the Equity that will be lost if SL is hit

- % of Balance – A % of the Balance that will be lost if SL is hit

- % of Free Margin – A % of the Free Margin that will be lost if SL is hit

- $ amount – The amount of money that will be lost if SL is hit

- Lot Value – Input for use with Static Lot

- i%R lost if SL is hit (for lots) – Input for use with %of Equity/Balance/Free Margin

- $ lost if SL is hit (for lots) – Input for use with $ amount

- Splits total (max20) – Split the Take Profit into more levels (the amount given here) Don’t set to 0

- Use Break Even ? – Enable or disable The Break Even mechanism

- Ticks in profit for application of Break Even - When this amount of points is reached in profit the Break Even is applied

- Trailing Method

- Standard - Classic Trailing with Trail Above level and Trail Distance

- Grid – Trailing on the TP’s that are produced by the Split input above

- Bar – Trailing in the Highs of previous bars for Sells and the Lows of previous bars for Buys

- Ma45 – Trailing on the Moving Average, period 45

- Ma100 – Trailing on the Moving Average, period 100

- Don’t Trail – No Trailing

- Standard Trailing Trail Above Ticks – Standard trailing, if this amount of points is crossed in a trade the trailing begins

- Standard Trailing Trail Distance - Standard trailing, the distance of the trail to the price in points

- Standard Trailing Acceleration – Speed of reduction of Trailing Distance with every new trail application

- Grid Trailing,Trail Above in Splits – After the amount of TP lines (from the Splits) is reached Grid Trailing begins

- Grid Trailing, Trail Distance in Splits – Distance behind price for Grid Trailing, given in amount of TP lines (from the Splits)

- Bar Trailing, Bars For SL Discovery – Bars to look back for Bar Trailing (to get the highest high, or lowest low)

- Kill TP on first Trail ? – if on, TP will be removed once the trailing begins

- Trail Only Above Risk: Reward Level – if enabled, trailing will only begin above a Reward level mentioned in “Trail above rr level 1:Reward - > enter reward”

- Only place Trail in profit area ? – Positive SL while trailing, only (if on)

- Close partial on Split levels ? – Partially close the trade on every TP line (from splits)

- Slippage Points Max – Maximum Slippage while entering trades

- Limit Spread ? – enable / disable max spread

- Maximum Spread Allowed (if the above setting is on) – Max spread value

Summary

- MArket Wave EA is a trend based EA that can be run on Forex, Indices and Stocks.

- Input parameters have to be optimized as per user need.

- Works on all timeframes.