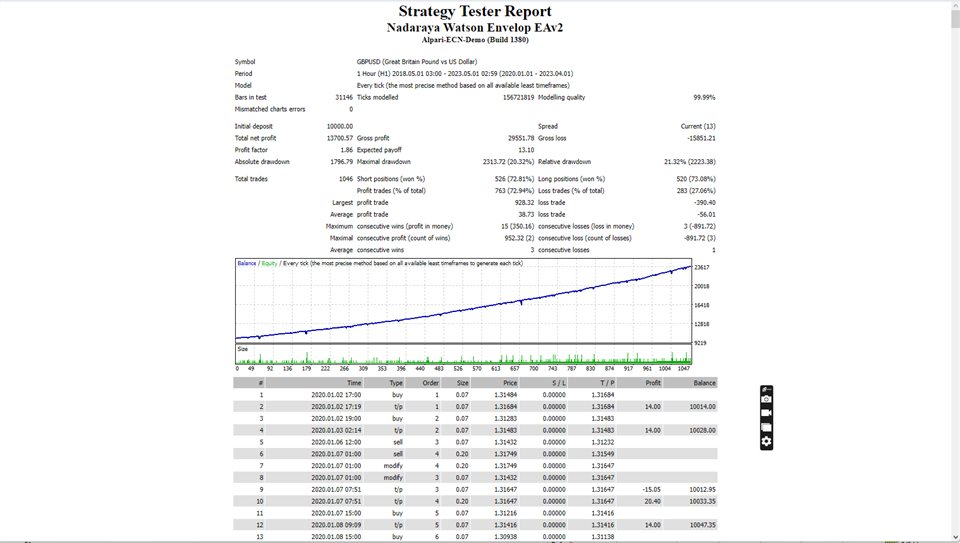

Nadaray Watson Envelope Strategy: The Nadaray Watson Envelope strategy is a technical analysis tool used to identify trends and support and resistance levels. It is based on the Nadaray Watson estimator, which is a non-parametric regression method. The strategy uses envelopes around price data to signal entry and exit points.

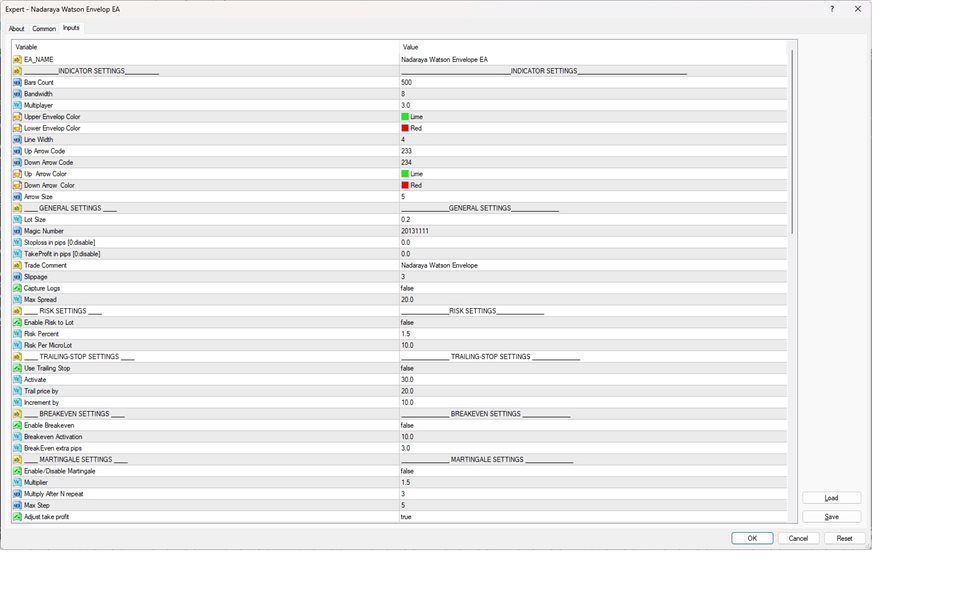

The Ea has the following features inside it

Grid Trading: Grid trading is a strategy that involves placing buy and sell orders at regular intervals, usually at set price levels above and below the current market price. The goal of grid trading is to profit from price movements within a range-bound market. The expert advisor robot uses grid trading to open and close positions automatically.

Martingale: Martingale is a money management strategy that involves increasing the size of a trading position after a losing trade. The idea behind martingale is that eventually, a winning trade will occur, and the profits will cover the losses. The expert advisor robot uses martingale to manage its position sizes.

Hedging: Hedging is a risk management technique that involves opening a position to offset the risk of another position. The expert advisor robot uses hedging to protect against losses in volatile markets.

Time Filter: The time filter feature allows the expert advisor robot to enter or exit trades based on specific times of day. For example, the robot may be programmed to avoid trading during low liquidity periods or only trade during specific market sessions.

Session Filter: The session filter feature allows the expert advisor robot to enter or exit trades based on specific market sessions. For example, the robot may be programmed to avoid trading during Asian or European sessions and only trade during the US session.

Day Filter: The day filter feature allows the expert advisor robot to enter or exit trades based on specific days of the week. For example, the robot may be programmed to avoid trading on weekends or only trade on weekdays.

Risk Management: The risk management feature allows the expert advisor robot to manage its position sizes and overall risk exposure. The robot may be programmed to limit its overall exposure to a certain percentage of its account balance or to use stop-loss orders to limit potential losses.

Safeguard Settings: The safeguard settings feature allows the expert advisor robot to automatically close out positions if certain conditions are met. For example, the robot may be programmed to close out all positions if the account balance falls below a certain level.

Alerts: The alerts feature allows the expert advisor robot to send notifications to the user when certain events occur, such as when a trade is opened or closed.

Informative Dashboard: The informative dashboard feature provides the user with real-time information about the robot's performance, including open positions, closed trades, and account balance.