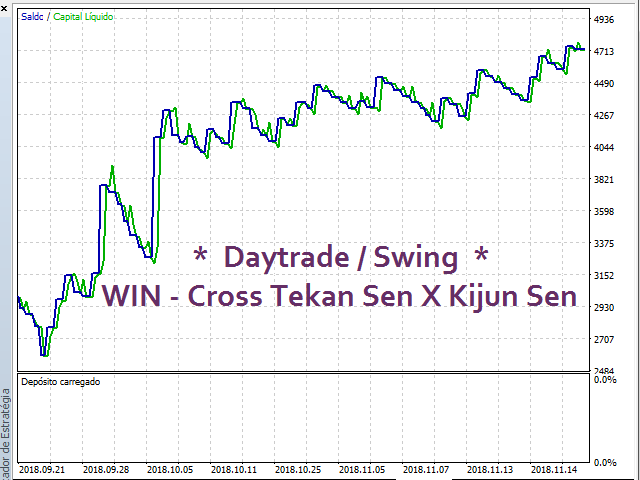

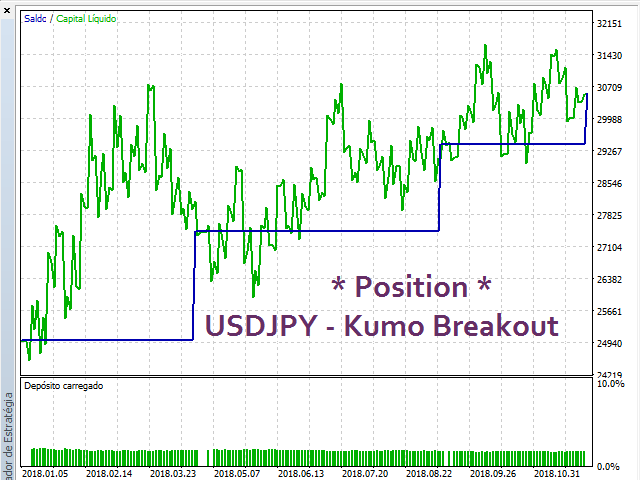

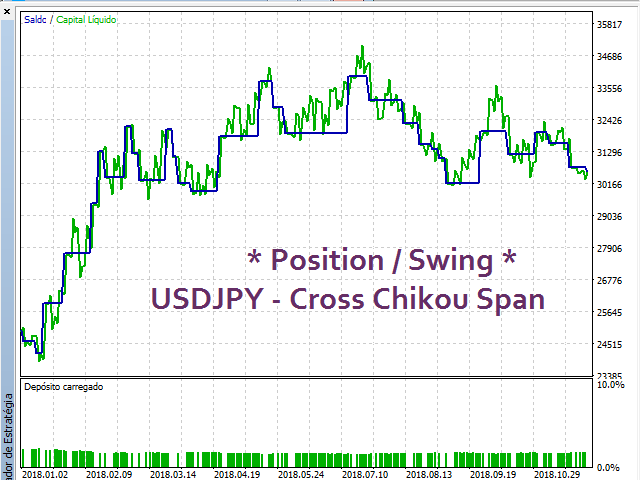

Intraday, Swing Trade ou Position.

Intraday, Swing Trade ou Position.

Risk management for entering and exiting positions.Works on all Timeframes.Smart management of Stop Loss and Trailing Stop, according to the selected risk profile.

It is recommended to test to choose the strategy combined with the most appropriate timeframe and risk management.

To force a Take Profit or Stop Loss value, simply set values other than Zero.

Parameters:

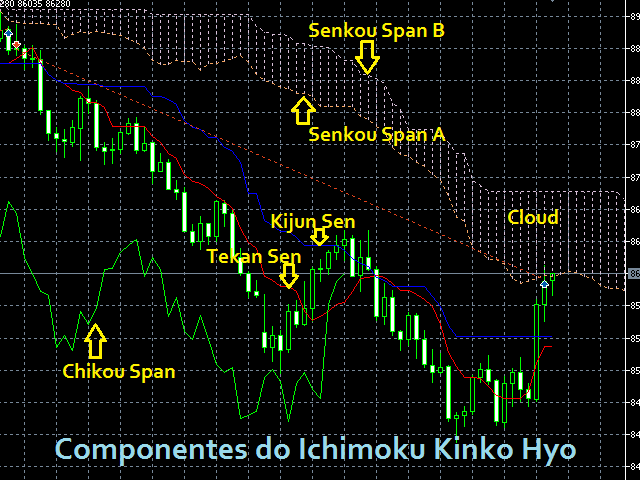

GENERALMagic Number - If you intend to use it on more than one asset (only Hedge account!), use this different parameter on each one.Lots (Zero = Min)Pips or Points? - Choose the preferred one for StopsStrategy (The Principal) - Explanations ahead *.Tekan sen - Main Indicator Configuration: Ichimoku Kinko HyoKijun sen - Main Indicator Configuration: Ichimoku Kinko HyoSenkou Span B - Main Indicator Configuration: Ichimoku Kinko HyoEnter Chance (Force Level to consider other entrys to agree with the Principal) - Explanations below *.Exit Risk (The Hardest, the longer and need more force to close) - Explanations ahead *.

STOPS & TRAILING STOPForce Take Profit (Zero = No Take Profit) - Take Profit, normalType of Stop Loss - About Stop Loss. It may be No SL, technical SL or Only Forced, which would be the Fixed SL indicated in the Force Stop Loss field.Force Stop Loss (Zero = No Forced Stop Loss) - Stop Loss, normal. It only works if "Only Forced" is indicated in the above parameter.Trailing Stop Type - No Trailing Stop options, or two forms of smart trailing: one following Tekan Sen, the other one follows Kijun Sen.n Ticks for Trailing OffSet - When following the Technical Stop Loss and Smart Trailing Stop, this parameter measures the distance it must keep from the point indicated by the function.

FILTERS

Use MACD as a Filter - True or false, choose if you whats this as a filter.MACD FastMACD SlowMACD PeriodMACD Price

Use RSI(IFR) as a Filter - True or false, choose if you whats this as a filter.RSI PeriodMax RSI for BuyMin RSI for SellRSI Price

Use ADX as a Filter - True or false, choose if you whats this as a filter.ADX PeriodMin ADX - Minimum value that the ADX line must be in order to validate an entry in the operation.

ALERTS

Push and sound. You can choose.

There's a way to do not open trades, if you want only the alerts.

TIMETime Controlled (Use "true" only Intraday!) - Set to True if you want to limit the operating hours of the robotInitial Hour - 0h to 23hInitial Minute - 0m to 59mFinal Hour - 0h to 23hFinal Minute - 0m to 59mMinutes for Final Output (0 = swing trade) - If you set Zero, and the robot does not exit the operation due to a stop or due to strategy, the swing trade will take place. The time that is placed here, in minutes, will be the time beyond the end time that will bring down operations.

For example:

Time Controled = TrueFinal Hour = 16Final Minute = 50Minutes for Final Output = 15

This would mean that at 4:50 pm it no longer enters any operations, but can close them. And at 5:05 pm, it closes the operation that is open.

STRATEGY:

Tekan Sen X Kijun Sen - The position and relative position of Tekan Sen X Kijun SenPrice X Kijun Sen - Nice for smaller timeframes. It's the position and relative position of Prices and Kijun Sen line.Kumo Breakout - This one cares about the Kumo! And don't like consolidations.Cross Senkou Span - For bigger timeframes. It reads the big movements and the focus is Senkou Span.Cross Chikou Span - Like the strategy before this, but the focus ir Chikou Span.ENTER CHANCE:

Any Chance (Only the Selected Enter)Some Chance (Selected Enter + Some Confirmation)Middle Chance (Selected + 2 Confirmations)Strong Chance (Selected + Most os signals confirm)EXIT RISK:Easy (Close the position if some signal indicates that)Middle Easy (Need more confirmation to close a position)Middle (Need at least 3 signs to confirm a close)Middle Hard (Need mor than the Middle)Hard (Almost all the signs need to confirm the close)

Do Not Close Trades by Strategy - Be careful! It closes only by