The system is based on critical price zones with high probability of mean reversion. The system use martingale with limitation of maximum steps. The system is using basket trading with several trend-following and counter-trend systems on several trading instruments. Current basket consists of more than 50 separate trading systems, that are working on 10-minutes timeframe on different currency pairs.

Parameters

- MartingaleMode - limit on the number of martingale steps;

- Aggressive - 12 steps;

- Moderate - 5 steps;

- Conservative - 2 steps;

- RiskMode - initial lot per 10000 units of the base currency;

- Lowest;

- Low;

- Middle;

- High;

- Highest;

Initial lot sizes depending on martingale and risk modes:

Aggressive Martingale mode Moderate Martingale mode Conservative Martingale mode Lowest risk 0.01 0.03 0.03 Low risk 0.02 0.05 0.05 Middle risk 0.03 0.1 0.1 High risk 0.04 0.15 0.15 Highest risk 0.05 0.2 0.2

- UseCustomMode - use custom parameters for initial lot (CustomLotFor10K) and maximum number of steps (CustomGridStepsMaximum);

- Prefix - symbol name prefix used by broker (for example, for currency pair name fEURUSD prefix is 'f', most brokers have no prefix);

- Suffix - symbol name suffix used by broker (for example, for currency pair name EURUSD.pro suffix is '.pro', most brokers have no suffix);

- Magic - base magic number of the EA. The EA will use magic numbers in range from [Magic] to [Magic + the number of systems in the basket];

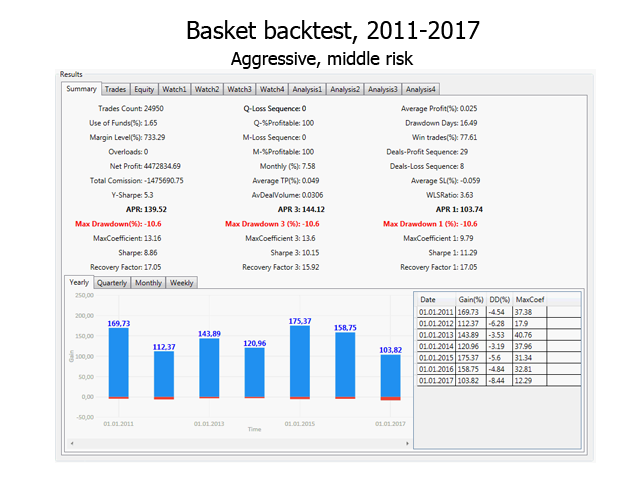

Backtests

All backtests were performed starting from 2011 using open prices only, because the EA works only with open/close prices of candles. Backtests were performed on the M5 period, because the EA uses this period to build the M10 timeframe for its operation.

Average gains, maximum drawdown and minimal deposit for each mode are presented in following table:

Aggressive Martingale mode Moderate Martingale mode Conservative Martingale mode Lowest risk Monthly: 2%

Yearly: 27%

Maximum Drawdown: 3.2%

Minimal deposit: 10000 units

Monthly: 3%

Yearly: 42%

Maximum Drawdown: 3.75%

Minimal deposit: 3333 units

Monthly: 2.47%

Yearly: 34%

Maximum Drawdown: 2.13%

Minimal deposit: 3333 units

Low risk Monthly: 4.83%

Yearly: 75.86%

Maximum Drawdown: 7.09%

Minimal deposit: 5000 units

Monthly: 5.32%

Yearly: 85%

Maximum Drawdown: 6.25%

Minimal deposit: 2000 units

Monthly: 4.3%

Yearly: 66.3%

Maximum Drawdown: 3.65%

Minimal deposit: 2000 units

Middle risk Monthly: 7.58%

Yearly: 139.52%

Maximum Drawdown: 10.56%

Minimal deposit: 3333 units

Monthly: 11.21%

Yearly: 252%

Maximum Drawdown: 12.6%

Minimal deposit: 1000 units

Monthly: 9.12%

Yearly: 182%

Maximum Drawdown: 7.51%

Minimal deposit: 1000 units

High risk Monthly: 10.4%

Yearly: 225.38%

Maximum Drawdown: 14.64%

Minimal deposit: 2500 units

Monthly: 17.4%

Yearly: 564%

Maximum Drawdown: 19.15%

Minimal deposit: 700 units

Monthly: 14.11%

Yearly: 377%

Maximum Drawdown: 11.3%

Minimal deposit: 700 units

Highest risk Monthly: 13.25%

Yearly: 339%

Maximum Drawdown: 17.43%

Minimal deposit: 2000 units

Monthly: 24%

Yearly: 1147%

Maximum Drawdown: 25.4%

Minimal deposit: 500 units

Monthly: 19.36%

Yearly: 703%

Maximum Drawdown: 15.08%

Minimal deposit: 500 units

Interface

User can perform following operations:

- Enable/disable currency pair and system for trading [green button in the first column near the system number];

- Close opened positions [blue button in the P/L column];

- Open a new position [green button in the P/L column for Buy, red button in the P/L column for Sell];

- Set trading mode for the basket (top left corner, ON – enable trading, MNT – only manage current opened positions, prohibit opening new ones);

- Downloading the required history. In case the bars in history for the M5 timeframe are insufficient, a message with a recommendation for download will be displayed. The currency pair with insufficient number of bars in history will be marked in red;